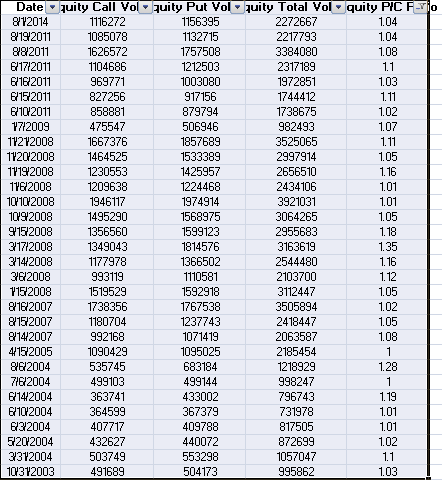

Equity Put/Call Ratio Greater Than 1.0 Instances Going Back To 2009

On Friday the equity put/call ratio spike to 1.04. That is the first time in 3 years that it has exceeded 1.0. While the initial contrary analysis of this data point is that the market is excessively fearful, I have a somewhat more complete view to offer, I believe.

What is evident going back over the last 2 bull markets and the intervening bear market is that the ratio spiking like this for the first time in a while may be a psychological point of change which is showing a shift to fear entering into the market that has not been present in some time. This is the type of market psychology shift that I would expect to see as a market is topping.

If you go back through price charts you will see that the ratio spike has typically first occurred prior to an intermediate swing low forming. So from this we can expect that the market will likely form a least a slightly lower low, which the S&P 500 did already today.

Secondarily, once an intermediate low did form after these prior instances, there were some sharp rebound rallies. But notice that none of the clusters (even in the current bull market) marked a lasting low. After some sharp rebounds, price broke to yet lower lows. So from this tendency - which has been very consistent - I would expect a sharp rebound here beginning within the next 1-2 weeks, but possibly after a further acceleration to the downside.

Next, all three of the last clusters of readings (Jan 2009, June 2011, Aug 2011) all led to 2-4 week rally attempts with the bulk of the rally happening in the first 2 weeks. So on this basis it may be reasonable to operate under the template that once we see a rally occur, we can look to short or inverse the stock indexes after a couple weeks.

Going back to the topping of the 2007 bull market high, the current market technical analysis set-up is most similar to clusters of readings above 1.0 that occurred in August 2007 and in June 2011.

- The rally off the August 2007 cluster led to a slight new bull market high, which double topped in the S&P 500 and led to the final bull market high after 8 weeks, on Oct. 11th 2007.

- The rally off the mid June 2011 cluster led to a slightly lower high in mid July in the the indexes (and a double or triple top on the Nasdaq 100), followed by a 21% high to low correction in the S&P 500.

So given the technical set-up here, in that we are still near the bull market high in prices, and the bullish psychology is still dominant, and the program trading systems are probably still set to "buy the dip", we may expect a rally back toward the highs on an upcoming rally. The biggest difference at this point, is that the current decline is very shallow in comparison to the price damage that occurred after those highs. So unless the decline deepens further, it would seem most likely that a new bull market high could very well occur here.

Click on Chart to Enlarge

This chart is the TOTAL put/call ratio with some analysis on it like I have shown in the past. The point here is that relative to the recent trend the ratio has spiked to a statistical extreme. That often at least slightly precedes significant lows, but it does put us on alert that the market may be primed to attempt a rally here.

After a similar spike in June 2013, stocks chopped in an up-down-up fashion for a week or so, before falling down another 3+% below the existing low of the correction. So given the modest decline so far, and the tendency for divergences to occur at the turns, it may be a reasonable idea to go with here as well if we see stocks immediately start to rally from this point.

So hopefully this look back has been helpful in planning and formulating realistic expectations for upcoming market action. I would suggest being ready for some further volatility. And also recognize the significance of a high put/call reading as a potential point of recognition or psychological shift in the markets here. Assuming that stocks don't fall apart from here - although not a safe assumption - the next rally may be a "last ditch" to exit the market on an investment basis before a broad spread sell-off takes place. That is my take on it.