Move the GTC buy stop on SLV down to 31.47. This continues to develop nicely, and another big payoff is likely ahead yet. I think this will make a big nose dive in the next few weeks/months, and then I think the odds favor a choppy longer lasting bear market, but I have intention of holding through that type of environment. So my intention is really to stay in for the next big move down, and then cover the trade.

Move the GTC sell stop on GLL up to 15.94. Gold has made a nice move since our entry, but as with silver, I believe the bigger payoff is still in the weeks ahead.

Place a GTC sell stop on the open EUO trade at 18.68. This is a 2x inverse Euro ETF, so it will move up as the US Dollar gains, and the Euro falls (and commodities fall also).

Saturday, December 31, 2011

Thursday, December 29, 2011

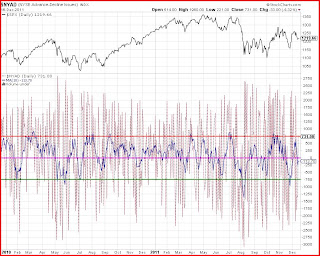

Waiting on a Breakout - Likely Down

Click on Chart to Enlarge

See the chart above for notes. The upside moves in stocks have been technically counter trend with respect to the ADX indicator. I think this suggests that the next breakout move will be down.

Click on Chart to Enlarge

Also a large triangle is forming after a downward move. Most triangles break out in the direction of the prior trend. I have no good reason to believe this one won't break out to the downside.

In either case, expect a MAJOR market move starting within the next week or two. If you are positioned against the trend, it will likely go very badly.

DJIA Chart

Click on Chart to Enlarge

The Dow 30 made a small range doji on Tuesday which was confirmed yesterday with a down day with a close at the bottom of the range. This occurred in the context of a 4 month high and an attempted breakout above the Oct high which failed as of yesterday's close back below it. Also the upper bollinger band was just above price. That may cap any breakout attempt here.

A lower low than Wednesday's will trigger a daily stochastics sell signal and the weekly stochastics are overbought. So this is a great short trade set-up here for discretionary traders. Also the price is just under the 78.6% retracement of the May-Oct decline. That is often the furthest a rally will go when maintaining the larger trend.

Gold and silver have both back-tested their bull market trendlines from the underside and now have broken to new lows as of yesterday. Gold gapped down today, and while on the surface it looks oversold, this has the potential to go into a near vertical decline in this position. I will move stops again on GLL and SLV soon.

Wednesday, December 28, 2011

TBT Stopped Out

The TBT trade open since October was stopped out at 17.60 on the 19th of Dec. Based on moving averages the bonds are in an uptrend. While some indications are that this market is overbought and should decline, if stocks falter from here, the typical response would be a flight to bonds. And I don't see anything concrete to suggest that won't happen again on any near term market scares.

Friday, December 23, 2011

Merry Christmas

Merry Christmas to everybody out there!

Expect very light volume today with no major moves. Looks like a modest gap up expected this morning, but I wouldn't guess there would be a large open to close move.

There are converging trendlines forming from the Oct-Dec high and Oct-Nov lows, indicating a possible large horizontal triangle formation taking place off the Oct low. Often times the upper trendline will be briefly exceeded before the "e" wave ends. I think we may see that here over the next few days, and then I expect renewed selling as we come out of the Holiday season.

The large, "smart-money" commercial traders have sold heavily at two distinct zones over the last year. The 1260 SPX level (which is basically the neckline of the head and shoulders top formation) and the 1320-1330 SPX level have been the areas where they have sold and would be expected to sell heavily and drive prices down again. Obviously we are in that 1260 area now, so it is possible that we are very close to seeing this rally attempt end.

All the best,

Pete

Expect very light volume today with no major moves. Looks like a modest gap up expected this morning, but I wouldn't guess there would be a large open to close move.

There are converging trendlines forming from the Oct-Dec high and Oct-Nov lows, indicating a possible large horizontal triangle formation taking place off the Oct low. Often times the upper trendline will be briefly exceeded before the "e" wave ends. I think we may see that here over the next few days, and then I expect renewed selling as we come out of the Holiday season.

The large, "smart-money" commercial traders have sold heavily at two distinct zones over the last year. The 1260 SPX level (which is basically the neckline of the head and shoulders top formation) and the 1320-1330 SPX level have been the areas where they have sold and would be expected to sell heavily and drive prices down again. Obviously we are in that 1260 area now, so it is possible that we are very close to seeing this rally attempt end.

All the best,

Pete

Sunday, December 18, 2011

US Dollar and Gold Update

Click on Chart to Enlarge

See chart above for notes on gold. All data confirms a major breakdown occurring in gold. We are likely to see sharply lower prices in coming weeks. I would anticipate at least to the green circle area by Jan options expiration.

Historically, bull markets such as the current gold and silver bull markets, are likely to retrace around 85% of the bull market on average within 2 years. This is taking it from the 2008 lows. So, that gives us some reference points that these are likely headed much lower. How long it takes, I think probably not 2 years in this case, but we will see.

Click on Chart to Enlarge

The US Dollar Index is confirming commodities should continue down. Watch for this to heat up quickly.

If there is a factor that keeps stocks from the typical positive seasonality over the next couple weeks, I believe it is the precarious position of gold and the corresponding breakout in the US Dollar Index. I would not dabble on the long side here.

Market Update

Click on Chart to Enlarge

The daily MACD has turned down on the indexes now as shown in the chart above. However, so far this move down is much slower than the move up off the late Nov low. So I think the odds favor the market turning up here, similar to mid April. The seasonality is positive and there is no confirmation of a new downward pattern yet, so the odds are that the market drifts up over the near term.

Click on Chart to Enlarge

The 10 day advance-decline average did not hit quite the extreme level on this last little rally, for a top of a leg up. The average crossed back below zero which is usually a decent continuation sign for a downward move after an extreme reading, but it may be a whipsaw here.

The equity put/call ratio was above 0.90 the last 2 days, which is a little odd given the mainly positive bias Friday. From a contrarian standpoint, it would favor at least a day or 2 bounce from these levels. Longer term I don't think it is very significant.

Again the 1226 SPX level is a significant harmonic level. If the market stays under that level (which it did close back under after moving above it Friday) it would favor continued weakness on that front.

Probably the most reasonable expectation is for a somewhat lackluster and slightly positive market into the New Year time frame. Then likely some selling afterwards would be my guess.

[As a side note, I will be making some significant changes to the blog for 2012. I will make a more detailed post going over those as I make them.]

Labels:

CPCE,

equity put/call,

nyad,

SPX

Friday, December 16, 2011

SLV Trendline Break

Click on Chart to Enlarge

The SLV etf is shown above. It gapped from above its 2008-2011 bull market trendline to below the trendline with a large gap down on Wednesday. I noted a similar thing in gold on Monday. When trendlines are broken with large gaps, that is typically significant. Everything still indicates this is headed much lower. From my study of how these things go, I would expect the market to correct at least down to the beginning of the final "blow off" leg up of the bull market. That would be around 17.50 at the mid 2010 consolidation level.

With options expiration today and metals set to gap up up today, I don't expect downside today. We may see a move back up toward the trendline on SLV today for a backtest of the trendline. But I would expect continuation downward next week.

Thursday, December 15, 2011

In Case There Was Confusion...

A reader asked if the new 33.00 buy stop was correct for the short SLV trade, thinking I meant 23.00. I didn't know if anybody else had this confusion. I had previously recommended a GTC buy limit order to exit the position, but I am now recommending to just cancel that limit order and wait for things to unfold. What I did suggest is to move the protective stop loss on the short position down to 33.00 from the 36.50 area.

Here was my brief reply with a little more info..

"This is a short position in silver. So the buy to cover stop is above current prices. That is the stop loss to trail behind the trade. I am not going to post a limit order to exit the trade yet if that's what the confusion was. The prior limit was 26.00 but I am just suggesting to cancel that right now. I think it has a lot further to fall. Probably 17.50 will be the next limit order, but I'll just trail the stop for now and see how it develops for a while."

Here was my brief reply with a little more info..

"This is a short position in silver. So the buy to cover stop is above current prices. That is the stop loss to trail behind the trade. I am not going to post a limit order to exit the trade yet if that's what the confusion was. The prior limit was 26.00 but I am just suggesting to cancel that right now. I think it has a lot further to fall. Probably 17.50 will be the next limit order, but I'll just trail the stop for now and see how it develops for a while."

Stock Market Update

Click on Chart to Enlarge

See notes on the chart above. While it doesn't look like we will get the ideal confirmation of pattern completion here, I would again refer you to the pattern in silver this past summer which is similar to this pattern in stocks. It did not give classic confirmation right after the price high, but it drifted sideways to the B-D trendline, then gapped below it. Then it continued to chop for a few days before the bottom fell out.

Given the seasonal tendencies for stocks to rise during December expiration week, and for generally low volume and positive seasonality through the New Year, we may see something similar to that in stocks from here.

So bottom line, from all the historical comparisons and price logic applied to patterns, time seems to be drawing close to a major leg down in stocks. One point of note is that the 61.8% retracement of the 2007-2009 bear market is at SPX 1226. That is basically right where the market is now. I have noted that there is a recent node of harmonic confluence there and it's a level of repeated support and resistance over the past 5 years. I have looked at these situations on charts before and many times if prices close sharply below that level, it can lead to fast declines to the next major horizontal support level. So the market is kind of teetering on the edge here. From the way commodities are positioned and the recent breakout to new rally highs in the US Dollar Index, I expect the market to fall through the support.

Wednesday, December 14, 2011

SLV Short Update - Trade Modifications

Cancel the GTC buy to cover @ 26.00 order on SLV. Move the GTC buy stop down to 33.00 on SLV.

Brief Notes

The S&P 500 did complete the stochastics sell signal on the daily time frame on Monday. So the stop for a new short entry would be above last week's high. I am not going to post any new trade on the stock indexes until I see how things unfold. All the other active trades already are set to make gains if the stock indexes fall.

As a side note, now that we have sit through a multiweek bear market rally in silver, I plan on removing the limit order to cover SLV at 26.00. I have said that I believe that this is a larger bear market in these metal, and I just wanted to cover at the first support before this rally. However, the SLV etf missed the target by a small amount and it did not get filled. But now we are in a better position where we can move the stop down a bit further and wait for silver to fall more. Given the long term context with silver likely to break its bull market trendline soon, I think there are quite a bit more gains to come on that position.

Also, gold did continue down yesterday. The lower daily bollinger band has now turned down. And the upper band expanded a wee bit. So this has the makings right now of a new stable downtrend developing in gold. Also the DMI/ADX indicator has moved into a a downtrend configuration on gold. The ADX has risen above 20 and prices are falling with downward directional movement strengthening.

As a side note, now that we have sit through a multiweek bear market rally in silver, I plan on removing the limit order to cover SLV at 26.00. I have said that I believe that this is a larger bear market in these metal, and I just wanted to cover at the first support before this rally. However, the SLV etf missed the target by a small amount and it did not get filled. But now we are in a better position where we can move the stop down a bit further and wait for silver to fall more. Given the long term context with silver likely to break its bull market trendline soon, I think there are quite a bit more gains to come on that position.

Also, gold did continue down yesterday. The lower daily bollinger band has now turned down. And the upper band expanded a wee bit. So this has the makings right now of a new stable downtrend developing in gold. Also the DMI/ADX indicator has moved into a a downtrend configuration on gold. The ADX has risen above 20 and prices are falling with downward directional movement strengthening.

Tuesday, December 13, 2011

Gold Update - Trendline Break

Click on Chart to Enlarge

The chart above is the GLD gold ETF. The red line is the trendline up since the 2008 low in gold. I had mentioned before that a break of that trendline would likely lead to sharp losses in gold. Yesterday gold gapped down from above the trendline to below the trendline. I always view that as significant. Based on everything I've shown in recent months I believe gold is most likely to continue its break down. There may be a backtest of the trendline here shortly after a break, but then any fall to new corrective lows, would be another sell point.

Silver is about 3% above its corresponding trendline and it really has space under it to fall.

I have us positioned in the blog trades to benefit from a general deflationary theme here in the coming weeks. Essentially we are short gold, oil, and stocks, and long the US dollar. The TBT trade is still open which makes us short bonds. If the other markets play out as expected I think the bond market may push up to new highs at this point, but unless it gets stopped out, I'll continue to hold.

Friday, December 9, 2011

DTO Trade Entry

The new DTO trade was entered at 42.20 on the open this morning. Used the GTC sell stop as receommended in the prior post.

Thursday, December 8, 2011

New Trade - DTO (2x Short Oil ETF)

Click on Chart to Enlarge

What I am going to do here is to post an inverse trade on oil because it is giving a really nice signal here, and everything is clear that it should lead to a nice decline. The dark lines on the chart above are projections of the typical declining legs in oil down from the recent high.

While I won't get into the chart here, on this rally open interest in oil has been falling as the price has been rising, and that is a short-covering pattern which implies that the larger trend is NOT up. Also, the commercial (smart money) traders have been selling on this rally as price has been rising. So that also suggests this is a sucker's rally.

Today's price break and MACD formation look to me like a "hook" on the MACD that should lead to continued selling with no new rally high. Since this pattern is very clear, and the possible reward on the 2x short ETF is around 100%, then I will post this trade, and give stocks some more time to develop and possibly post a trade if/when a more clear downtrend emerges. For those interested I would still suggest taking bearish technical trade signals on the stock indexes any day now.

New Trade:

Buy DTO with a market order at tomorrow's open. Place a GTC sell stop at 37.67 immediately after entry, and use that stop for position sizing also.

Market at Channel Resistance - Possible Sell Tomorrow

Click on Chart to Enlarge

A lower low in the S&P 500 tomorrow will trigger a trailing 1 bar low sell signal in the 14,3,3 stochastics. Previous signals are shown at the red vertical lines. Recent sell signals have been good times to get out of longs on a trading basis.

The blue lines denote the channel lines of the "flat" pattern that formed from April to July. The market has repeatedly used those channel lines as support and resistance thus. The market has again begun to reverse off the upper channel line. Also the last few days the S&P has been up against the 200 day SMA and has reversed down off it again today.

I view 1295 as the major horizontal resistance, so if the blue channel line is broken, that 1295 will be the next resistance.

It is not surprising to see stocks sell off a bit heading into the weekend. If the market truly is hinging upon anything that happens out of this ECB conference this weekend, then it may be expected to see some selling prior to "the news." Then it would not be uncommon for seemingly "good" news to come out from the meeting with a "Yea! We fixed it!" kind of headline, but the markets sell off on the "good" news.

If a lower low is made tomorrow in the S&P 500, which I think is quite likely, then I will post an inverse ETF trade on one of the indexes with a stop above the October highs. Time is running thin on all bearish scenario projections from my perspective. So it makes sense to take any sell signal here, and be willing to do it again over the next few weeks if the market does rise modestly further and stops the trade out.

Tuesday, December 6, 2011

S&P 500 Pattern Update

Click on Chart to Enlarge

Based on the pattern development I have posted here over the last year or so, here is my updated analysis. The first vertical blue line at the left is where I suggested a pattern completion this past summer. And it was confirmed at all levels expected by the following explosive price move down. So it is very clear to me that an upward market phase completed there. Since then we have spent 4 months retracing only about 75% of that decline which took about 2 weeks.

I see two possible ways to logically label the price formations since the August 9th low. Based on time relationships and cycles I have labeled it in the form above as a developing corrective pattern where the "e" wave is expected to approximate the "a" wave in price and time or relate by a 0.618 ratio. The pattern would be very similar (but with a larger "b" wave) to the pattern in silver which topped out this summer before the major swoon in September. Check out that pattern here. Also the great discrepancy between the initial sharp move down and the overlapping correction to follow is similar to what happened in silver. The pattern would also be similar to what happened in gold in 2008 as I have labeled in the chart below. If you look at the declines to follow these patterns you see they are very sharp. So buying January OTM put options may be a high reward trade opportunity for a move projected to break past the Oct lows in the S&P 500.

Click on Chart to Enlarge

The other way I see this pattern possibly being labeled is as an ABC down into the October low, and a still developing upward pattern with a complete A and B and working on C. However, the time relations are so similar in all the waves since August, that the way I have studied these patterns, I would not label it as such.

The conventional Elliott wave labelers I'm sure would say we currently are in wave C up off the Oct low, and they would probably expect a terminal impulse for wave C. Then the next move down would be extremely large and possibly bigger than anything we even saw in 2008.

Back to the first chart above, I have placed a tight red circle showing the resistance area on the S&P 500. The light green line is the average of all the bear market rallies since 2000 that I have shown before. That projects to right around this weekend. Also, the vertical blue lines from the pattern ending in July would show a nice time symmetry if the upward move were to complete right there.

All this is in the context of a possible "buy the rumor, sell the news" type of scenario with the European Union meeting this weekend. Not too dissimilar to what happened heading into the debt ceiling issues this summer in our government.

IF such a pattern as I have projected is completing soon, then we will have to see a major move down to confirm it. The move should at a minimum retrace the advance since the recent November low in less time than the rally took to form.

Saturday, December 3, 2011

Indicator Update

Click on Chart to Enlarge

The VIX has touched the lower bollinger band 3 days in a row. The last time this happened was right before the market plunged in the summer. However, with the bollinger bands relatively narrow, this set-up looks most similar to the Sept 2010 where the VIX began a new downtrend as stocks rose steadily. The VIX didn't CLOSE outside the lower band though, which is a better contrarian signal.

Click on Chart to Enlarge

This is a chart of daily TICK values. It is neutral after an extremely low reading at the end of last week. I really just use the moving average of the TICK values to gauge extremes then look for divergences at/after extremes. I take this as neutral currently.

Click on Chart to Enlarge

This is the advancing-declining issues chart with a 10 day average. Again look for it to reach extremes and diverge. Use the average crossing the "0" line as a confirmation of new intermediate term trend after a divergence. The average has not crossed the 0 line yet, but is close. I take this as neutral, but with upward momentum.

Click on Chart to Enlarge

Since May the equity put/call ratio has traded mostly between 0.55 and 0.85 with moves outside that range creating inflection points. The current reading is neutral. It may take a reading closer to 0.50 before any significant pullback.

At this point nothing looks to be stopping the index from moving to new rally highs off the Oct 4th low. It seems most likely that the market rises for the next 2-3 weeks before topping. Stock has tended to rise into options expiration week for the last few years. So that is still a positive as is seasonality into the new year. If the market makes it till Christmas without a major break, then I expect a top to form around that time.

Thursday, December 1, 2011

Gold Update

Click on Chart to Enlarge

This is an updated chart of gold which I had posted on Nov 15th. The green line is the typical 1st bear market rally after the first leg down off a high in gold. The projection is to Dec 7th, which is not a magical date just the average for a high of the 1st bear market rally. Given the current environment, it seems likely for gold to continue sideways to higher, possibly making a new rally high over the next week or so.

As a side note, there may be a significant reaction after next weekend when there is supposed to be a significant European Euro/debt meeting. It is possible that the gold market remains rather subdued until then. That meeting is Dec 9th, next Friday. So a possible major shift in gold prices may coincide with some policy decision or indecision in the news on that front.

The pink line in the chart above is the bull market trendline since 2008. If that trendline gets broken I think it will be a waterfall type decline with some dramatic losses in a relatively short time. The next chart support below would be the 1300-1400 range.

Subscribe to:

Posts (Atom)