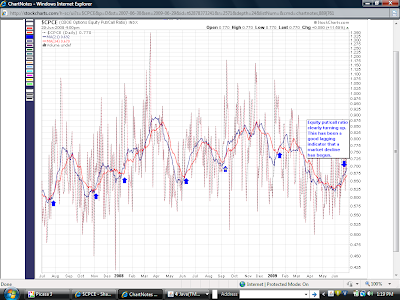

This is just a quick post showing that the equity p/c ratio averages that I have discussed and shown before have clearly turned up. This has been good confirmation in the past that a market correction is underway.

Tuesday, June 30, 2009

Equity Put/Call Chart Update

This is just a quick post showing that the equity p/c ratio averages that I have discussed and shown before have clearly turned up. This has been good confirmation in the past that a market correction is underway.

TICK Divergences

The chart above is the TICK. I usually don't go into much detail on this, and there are several different ways I have seen to measure the TICK, to gauge whether it is confirming a trend or diverging. I am going to briefly present one simple way to look at it without having to get too complicated with spreadsheets, etc.

First off the TICK is a measurement of how many stocks traded on an uptick vs a downtick. I believe it is calculated every 6 seconds during the day. So if more stocks traded on upticks during those 6 seconds, then the TICK will be positive, and vice versa. Obviously, when stocks are trading largely on upticks relative to down, that would suggest buying interest, and vice versa. Since most trading these days is computerized "program trading", following the TICK will help you understand what direction these programs are going. For a day trader, they basically just want to go with the prevailing trend of the TICK on any given day. Short-term swing trading like I do for the blog, will want to go with the intermediate trend (10 or 20 day avg.) generally, but also may fade extremes moves away from the averages.

One thing I look for is whether some moving averages of the TICK make new highs when prices do, or if there is a waning TICK, creating a divergence. In the chart above each TICK bar is 30 minutes of trading. Then I have two moving averages which represent the 10 day average of TICK (blue) and the 1 day average (red). In order to spot divergences I typically just look at the red line (1 day avg) and see whether it makes a new high as prices do. I have two nice examples shown recently (with pink trendlines) where the TICK failed to make new highs as prices was moving to new highs. The prior one to today was June 11, which was the rally high thus far. Today there was a very similar TICK divergence, even though prices were up.

While it is yet to be seen whether this will lead to a decline, these type of divergences often lead to some degree of reversal in the following days. At any rate, you are able to objectively gauge that the program buying is less enthusiastic at this higher price than it was a day ago at a lower price. One component of the short-term model I use for the blog trades is a variation of TICK analysis. At times just an extremely high or low average TICK for the last trading day will provide a good time to go against the trend, but divergences after recent extremes are even more powerful in my experience - and that is what we are seeing right now.

So we are in the midst of a Holiday shortened week that is likely to experience low volume and we are also right in the window of the seasonal low in volatility. That may dampen any potential for big moves over the next few days, but it is hard for me to see the market marching much, if any, higher for the rest of the week. We'll see.

Monday, June 29, 2009

Possible Head and Shoulders Forming on Daily Chart

I don't have a lot to say and may not for a couple weeks as far as the larger context of what is going on. I always try to give that context because it will help to give confidence when the short-term is set-up favorably with the longer term picture. Also, I assume most everybody is interested in the longer term market picture for investment purposes.

What I do feel pretty strongly about is that the market is unlikely to see new highs above this month's highs. This correction is taking too long and clearly has a different quality (less healthy) to it from a number of angles. However, I really don't know what to expect the next 2 weeks particularly. If a head and shoulders top on the daily chart is forming, then I would expect another decline followed by another tradable bounce up from the neckline area.

If that does occur I think it will be very difficult for most technical analysts to initially view the following/expected decline as part of a new leg down that will take the market to new lows. I assume that most will, yet again, be looking for a "retest" of the lows to form a larger head and shoulders bottom with the Nov and March lows. I would also have that in the back of my mind as a long-shot secondary scenario for the long-term picture.

From a short-term trading perspective, in times like these, when the market is trading in a range and the 20 day moving average is flat, I tend to be willing to take bullish or bearish trades on short-term extremes. As shown in the chart, if the main support at 88ish holds on the next oversold signal, that would probably be a good bullish opportunity. If/once that support is broken by a market close, I don't anticipate myself having any interest in bullish set-ups for a while. Unless the market tips its hand over the next few days, the blog posts the next couple weeks will probably be limited to entries and exits for existing or new trades.

On a separate note, I have created an options trading blog, but am unsure exactly what direction I want to go with it. I used to at times post trades that I was making on this blog, but I have tried to focus solely on equities, on only one methodology, and basically one time frame for the last year. I think that has been beneficial in a number of ways, so I don't want to digress. However, I do believe the next several months may be a great market period for directional options trading, and so I think this could be an exciting time to learn about or participate in the options market. I will probably require some feedback to decide on how to organize that blog, so I may post a poll with a few basic questions, but anyone interested may want to drop a comment with any thoughts.

Friday, June 26, 2009

Further BGZ/BGU Info

Pete

Leveraged ETF Traders Need to Know This

First off, a reader had asked why, in practice, I don't typically immediately enter the opposing ETF when exiting a blog trade. So if I am in SDS, why not immediately enter SSO when exiting SDS? I think the idea is that you want to trade as much as you profitably can. While I have in some form or another addressed this issue in the past, if you are a consistent follower of this blog, especially if you participate in blog trades, then please read the comment section from the previous post to get some dialogue on this idea. I have decided not to make a separate post, because the basic info is already in the comment section.

Now for today I wanted to discuss some things about the Direxion 3x ETFs BGU and BGZ. I occasionally recommend these for trades on the blog in anticipation of catching a major directional market movement. However, holding these funds for the long term is a losing proposition.......if you are long. So you must be careful about holding these funds if they go against your position. They are great for day trading and for capturing leveraged moves on short market swings, but don't plan to hold these funds. And here's why....The funds are decaying over time.

The chart above is a chart of BGU, the 3x bullish fund, in candlesticks, and the S&P as a line graph for comparison. Do you see that the BGU has lost about 33% of its value since inception? Despite the S&P only being down about 2%.

Now this chart is of BGZ and the S&P 500. Do you see that this fund is down about 43% since inception despite the S&P being down 2%? Both funds are decaying.

So while I don't have a mathematical model on how these funds are constructed, it seems that the most sensible may to play these funds for the long term, is to SHORT THEM BOTH! If you shorted them both at inception you would be up about 34% on one and 43% on the other despite the S&P going basically nowhere from start to finish.

Now if the funds both decline in value to very low levels, you probably won't get large enough % changes to make them worth shorting, but for now, it is certainly something to consider. In fact, if anyone wants to look into this further, Direxion just launched 2 new 3x funds specifically mirroring the S&P 500. The bullish fund is UPRO and the bearish fund is SPXU. So, while I am not officially recommending this, it certainly may make sense to short both these new funds for a time.

I have considered something of this nature for a while for blog purposes, but from my perspective I think I will wait until I believe the bear market is almost over, and then suggest shorting BGZ at that time, as the result would probably be a near 100% gain by the time the next major leg up in the markets gets underway. It would probably also be a decent idea to short BGU right now, if my outlook is correct on the markets falling further.

In any case, I know that most people who follow this blog probably have recognized both the benefits and dangers of these funds, but I wanted to make it very clear, and make sure that everyone knows not to get tied up in holding a losing trade for several months on these funds. Even if the market comes back your way, the fund may have decayed so much, that you never get back you investment, or the gain will be smaller than you may expect.

Thursday, June 25, 2009

New SDS Trade

New Trade Recommendation:

Buy SDS today with a market order. Current price is 55.69 which will be the blog entry price.

Pete

Wednesday, June 24, 2009

Still Waiting for A Good Set-Up One Way or the Other

I really don't have a great idea of what will happen tomorrow. I tend to favor the day following the announcement to move opposite the post announcement reaction. That would suggest an up day tomorrow, or at least in the morning. Supportive of that idea, the Dow moved beneath Tueday's low today, but none of the other major indexes did. So this may be a short-term non-confirmation, indicative of more strength in the broad market. That move on the Dow set-up a decent looking potential bullish divergence on the technical indicators as well.

On the other hand, my experience tells me not expect a major rebound until the first support is broken (this being more true if the March-June rally proves to be a bear market rally). Since my perspective is that the market is now in a correction/leg down, and the very early stage at that, I think it is wise to require that the support be broken before taking any bullish trade.

When a major "pattern" completes in a market, there is usually a sustained thrust in the new direction that often entices those now accustomed to buying (or selling) small corrections against the prior trend to buy. The problem is that early (or about halfway through) in the thrust there may be a brief pause, even with a nice reversal bar, that is like Mr. Market Angler throwing the bait. Then the potential reversal fails in a dramatic way, and the hook is set. While that remains to be seen in this case, my suspiscion is that we may just be seeing bait right now.

One concept I have discussed several times on the blog, especially in the last 1 or 2 months, is that of a "measured correction." In a trend, any corrections against the larger trend will tend to be roughly similar in price and time on average. An early sign of a larger change in trend, is when a correction is larger in percent, and takes longer than the largest correction so far in the trend. As it stands now, the largest correction in the S&P before this one was 6.5% and took 5 days from high to low. The current correction has gone about 7% and is 8 days from high to low so far. So we have already seen a bigger and more time consuming correction, though only marginally. That is why I think the current level may be a "bait" area.

Bottom line - don't be surprised to see another quick and sizeable move down from here that undercuts major support at 878 on the S&P. If that move down doesn't start tomorrow, then there may a great opportunity for an inverse trade on further strength tomorrow.

Pete

Possible Inverse ETF Trade Today

Be sure to check back in the last hour of the trading day for a potential new trade.

Tuesday, June 23, 2009

SSO Trade Did Not Trigger - Cancel the Orders If Necessary

Pete

Limit Order for a Potential SSO Trade Entry

With yesterday's decline, several short-term historical comparison studies suggest a solid bullish edge looking out 2-3 days. In this time frame there is going to be the FOMC announcement on monetary policy which does create the potential for a solid rebound. I have seen studies from Quantifiable Edge's blog which suggest that Fed meetings are more likely to end positive when the market is short-term oversold coming into the meeting (I believe a 2 period RSI was the gauge used).

Taking all this info together, I believe a nice bullish opportunity could present itself if the S&P falters from the open today and undercuts the 880 level. So I am going to suggest using a limit order to potentially enter SSO (2x bullish S&P ETF) on a slight move below that level in the S&P 500. That being said, my view is that this is a new downtrend, and there is certainly the potential for loss on the trade. If the order is filled today expect either a stop placement or exit by tomorrow. Anyone who cannot check for and act on blog updates several times over the next day or two should almost certainly sit out this trade.

Potential Trade

Place a day only limit order of 23.80 to buy SSO. I am not going to suggest an official stop loss on entry, but 5% (basis SSO) would be reasonable if you need one to determine position size.

Pete

Monday, June 22, 2009

SDS Trade Exit and Waiting for a Possible Bullish Set-up

The FOMC announcements have typically led to market gains in recent months. While I don't know if that will be the case this time, any further weakness tomorrow will clearly tilt the short-term odds to the bulls side (they probably are already), especially if the S&P breaks below 880 at least briefly. If the S&P does fall below 880 tomorrow, I will likely suggest a trade on SSO or QLD hoping to catch a quick rebound after the break of the first support.

However, I will be extremely quick to get back in a bearish ETF trade at the first signs of another short-term overbought signal. Today basically was the nail in the coffin for this rally from my perspective. I feel almost certain that the markets will not see new highs for several months at a minimum, and probably more.

Strong gains on FOMC meeting days tend to be reversed in the following days to a large extent, and fading those moves has worked like a charm for past blog trades. So it seems like a lot to ask for, but pronounced weakness tomorrow could set up a nice bullish trade, with the possibility of a great bearish trade entry shortly thereafter if there is a large rally around the FOMC meeting. I expect volatility to start to pick up quickly, but would encourage short-term traders to not get too aggressive on entering short/inverse trades until we see the first bounce/overbought signal off this breakdown.

The current BGZ trade is now profitable as of today's close, and market conditions justify a longer hold. I don't expect to exit this trade for a few weeks or more, so while it can be nerve racking to watch these 3x ETF's go up and down, I plan to just let things fly a bit before getting a profitable stop in place.

Pete

Limit Order For SDS

Trade Recommendation:

Place a day only limit order to sell the current SDS position at 58.06.

Pete

Sunday, June 21, 2009

Expectations for The Next Few Weeks

The chart above is the S&P 500, SPX. The red line shows what would be a typical angle of descent for the market if this is a continuing bear market. Even if this were the first correction of a new bull market, the market may follow that rate of decline, though less likely. The green dashed line projected down from the recent highs, would be more indicative that the bulls have regained longer term control.

From going over historically comparable instances to the current market, I would expect a large retracement of this rally to near where the red line and green horizontal line intersect in late July. That may seem crazy now, but assuming you have been following the market for the last year or more, it should not seem too crazy. While this is obviously looking pretty far ahead, if the market did follow one of these general scenarios, I would be looking to exit the current BGZ trade sometime in July, with a good possibility of re-entering later if conditions suggest a continuing bear market.

Looking at the more near term, the pink horizontal line is the first major support which should be expected to be broken in the next few days (or next week) if the market rally has topped. For the current SDS trade, a sell limit order corresponding to that support level will likely be the initial strategy I will go with for potential exit if there is market weakness early this week. If the market continues sideways/up, I will just be waiting for the next oversold signal.

Pete

Friday, June 19, 2009

Gap Up on Options Expirations Suggests Weakness into Early Next Week

Exit will be at the next short-term oversold signal.

Pete

Thursday, June 18, 2009

New SDS Trade

New Trade Recommendation:

Buy SDS today with a market order. Current price is 55.75 which will be the blog entry price.

Pete

Possible Trade Today

Pete

Wednesday, June 17, 2009

More Supporting Evidence of Topping

The top chart is the VIX with some trendlines in green, a 20 day moving average in blue, and a 63 day Time Series Forecast in red. The VIX has now closed above the down trendline from March. It has remained above the TSF 63 on a closing basis since the last week of May. Now it has made its 3rd consecutive close above the 20 day MA, which many watch. It only barely closed above that average 1 day (March 30) during the rally since March.

The VIX is the commonly followed "fear gauge" which really measures premiums on the market value of options. When fear is high or increasing, traders will be willing to pay more in premium to make sure they have put protection. Typically a rising VIX reflects a falling market, and more demand for put options, and thus higher premiums. The fact that the VIX appears to be turning up after a long downtrend is supporting evidence that the market may be leveling off on this rally.

The lower of the 2 charts is the equity put/call ratio which is a good contrary indicator. I had posted a month or so ago about looking for a moving average cross-over and for the averages to turn up to help confirm a shifting sentiment in the options market that has been a good slightly lagging indicator of the ends of bear market rallies the last year or so. Yesterday's spike in the ratio (relative to recent readings) basically broke the down trendlines since January. Again, this could be intrepretted as a shift toward more fear in the options market and potential for future declines.

On a different note, the short-term model that I use for blog trades got solidly oversold Monday, yet failed to rebound Tuesday. Then today, there were further declines before a modest rally attempt. This type of failure to rebound from oversold conditions is often an indication of a shift in trend from the prevailing trend. Particularly if stocks continue down tomorrow or even into Friday, that would be a big hint, that this rally is in all likelihood over.

Pete

Tuesday, June 16, 2009

Quality Trade Set-Ups on Different Time Frames

The 3 charts above from top to bottom are Qualcom, Exxon, and Potash. These are all showing nice tradable patterns on 3 different time frames. It is important to time your trades with the general market, and now that it seems almost certain to me that the general market will be heading south, it is a good time to look at individual stocks or options on them.

QCOM is showing a potentially long term short trade. From the looks of the chart, it would not be surprising to see QCOM near $20 by early to mid next year. That would complete a potential Gartley Pattern off the 2008 highs. A Gartley pattern is where wave A retraces to the 61.8% level and then the wave C retraces to the 78.6% level, which is at about $20.50 on QCOM.

XOM is showing an upwards ABC correction with nice time relations and a nice long-legged doji at the last swing high. This could be a nice intermediate term time frame trade for a short sale. Notice how far XOM is from its January highs as the S&P actually slightly broke above those levels. That may indicate future weakness.

Lastly POT is showing a very nice head and shoulders top on an hourly chart. There is really no support until about $96 on this, so an entry could be made short with a stop above the high of the right shoulder.

Pete

Monday, June 15, 2009

This Rally is Probably Over

As I have said at basically every potential top for the last month or so, when the top is in, you will typically see a larger (and often faster rate of decline) decline than any pullback during the uptrend. This often undercuts the first major support before making a significant pause or rally attempt. That would still be 4-5% lower than the current S&P price.

Pete

Sunday, June 14, 2009

ROBO Ratio, Fibonacci Arcs, and S&P Time Analysis.......A Storm is Brewing

Today's video discusses a bit about how to use Fibonacci arcs, and what they may be telling us right now. Also takes a look at the time relationships of recent legs up and down in the S&P 500 since the Oct 10 2008 crash low.

Bullish extremes like this are less frequent than bearish extremes, and prior moves of the ROBO ratio above its bollinger band has typically occurred only in the very late (often almost the absolute peak) stages of rallies if at all.

At a time such as this, it is interesting to wonder what will be the next potential "driver" of a decline in stocks. While I can't tell you for sure, an interesting news item broke late last week that makes you go hmmmmm. I'll let you read for yourself and do the follow up, but if this proves to be legit, then it will raise many serious question about our own government's past conduct in the sale of bonds, and also obviously makes you wonder if someone else (foreign govt.?) knows something we don't and is trying to get $135 billion in cold, hard cash for their US bonds before we all find out.

Regardless, it pays to train yourself to think opposite the crowd. Things look so rosy now to the hopeful eye, but all the data I have presented in recent weeks should be as good as a CNBC news banner to tell a bull that he is in danger of being slaughtered. Time will tell, but if I was long the stock market, I would cash in rather than wait and find out.

Friday, June 12, 2009

Quick Important Note

Additionally, on a technical note, the S&P made a third attempt at new highs above the January 2009 highs yet reversed. From experience and reading on this type of action, a 4th advance above the highs would likely have a bullish resolution, but any decline below last week's low without a 4th push will likely result in major further downside in the next 6-8 weeks.

In sum, from both a sentiment and price pattern perspective this is easily the best bearish topping set-up to enter short/inverse trades that we have seen during this rally. While it will take some downside to "confirm" the bearish reversal, I believe the risk to reward is the best right now. Looking out 2-3 months from now, I would gauge there is a bare bones minimum of 3 times the downside risk versus upside potential, but realistically it is probably closer to 6 or 7 to 1, and if yesterday was the high of the rally then probably 10 or more to 1.

I feel it is imperative to continue to take bearish set-ups for short and intermediate term traders and also to maintain the current BGZ blog trade for the time being.

Pete

Thursday, June 11, 2009

Shooting Stars and DIA Northern Doji

The chart above is DIA which is the Dow 30 ETF. The late day revesal today caused DIA to form a classic doji candlestick. The doji is a fairly reliable reversal candlestick in and of itself and dojis marked both the January 2009 top and the March 2009 bottom. Additionally, the S&P 500 has been stalling at a key chart based resistance point around the 945 level and the January highs. The Dow has been lagging and has not reached the January highs. Today DIA filled the breakaway gap down from early January and then reversed.

This set-up looks very promising for topping potential. If this is a significant top, then it would typically be followed by some strong follow through to the downside over the next 1-2 days. A gap down and a solid black candle tomorrow would provide enough confirmation for aggressive entry on short positions with a stop above today's high in the indexes. Additionally, a sell stop corresponding to last week's lows could be used to enter short on further weakness.

Over the last month or so, just about every bullish extreme conceivable has been objectively reached. The most recent ones from composite surveys and Nasdaq/NYSE volume ratio are typically longer term signals. I don't cover breadth data too much on the blog because I really don't think it is that useful for short-term trading. However, when looking for major turns and the health of market rallies, it is much more important. I'm not going to cover it here either other than to say that on the push to new highs above the May highs, the participation has been waning in terms of peak advancers versus decliners as well as stocks making new highs. So while we have seen extremely/"excessively" bullish breadth for a couple months, we are only recently seeing a breadth divergence with new price highs. This divergence is also confirmed by On Balance Volume in the indexes.

The investment herd has, as measured by objective and historically proven data covered in recent weeks on the blog, shifted to a decisively bullish posture. I think the current consensus is borderline manic from some anecdotal evidence as well. I frequently read the comments sections of a number of blogs looking for reader comments about what they think the market will do. I basically look for the type of comments that are non quantitative yet stated as matter of fact (or at least charmingly ignorant). Recently I have seen a surprising number of comments of people who are just now looking to re-enter the stock market because they are in danger of missing out on the new bull market, etc. Call me stupid, but I don't think you've done your homework if that is your view. I think you are panicing about missing an opportunity. That is raw emotion.

Maybe I'll go into more detail this weekend, but I've covered just about all the relevant data that one should need to see that the market is in danger of a significant pullback. The only missing piece is price confirmation in the form of a larger % decline than any pullback during this rally since the March lows. The largest pullback in the S&P 500 since March 6th was about 6.5%. So I think any decline greater than that, especially if it reaches 8% or so, should be treated like the angel on your right shoulder telling you that the market is going on to significantly lower price in coming weeks/months.

Pete

Wednesday, June 10, 2009

BGZ Update

Today looks like a high reliability bearish engulfing pattern in the making in conjunction with a "sell the news" type mentality among smart money in recent days.

Pete

Tuesday, June 9, 2009

A Few More Topping Signs

However, for a good market recap check out Cobra's market view from the links sections on the right. The Nasdaq/NYSE volume ratio is getting stretched to extremes indicative of longer term tops in the past. Sentimentrader.com posts basically the same chart and it is showing a lesser extreme but still on par with some past peaks. Quote vendors differ in volume readings I guess.

Also, for those who are familiar with the VIX/VXV ratio, it closed at 0.92 - its lowest level since the January 2009 top. The close was also outside its bollinger band which has been good for a short-term pullback at least on the last few occurences.

Also, for anyone interested in even more geeky ways to analyze put/call data, check out this link from Schaeffer's Research from yesterday. It discussed a "gamma weighted" put/call open interest ratio which is showing a great overabundance of near the money calls versus puts.

Other than that, the only major technical things are another failure for the S&P to breakout from the January highs and a short term potential head and shoulders top easily seen on a 5 day chart of SPY, IWM, etc.

Pete

Monday, June 8, 2009

SDS Trade Exit

Trade Recommendation:

Sell SDS today with a market order. Current price is 54.70 which will be the blog exit price.

I will update later on the BGZ trade if necessary.

Pete

Optional Protective Stop on SDS

I will still post if/when a short-term oversold signal comes, but the rationale here is that if "the high" is not in for this advance yet, the market will likely find support soon, and could move explosively to a new high.

Looking at the S&P futures chart (symbol ES) for Friday, a classic long-legged doji formed. With the gap down this morning, this sets the potential for a longer term reversal based on that pattern. This makes me think that new highs are unlikely the next few days, if at all. But keeping losses to a minimum is the name of the game, and quickly reducing risk to nothing if possible can be a good pyschological tactic to allow you to stay with a good trade until the signal comes and avoid the risk of the trade going negative and stubbornly holding on to a loser if the market does not follow your expectations.

Pete

Saturday, June 6, 2009

S&P 500 Update Video

This video covers the stock market with focus on the importance of the 950ish level on the S&P 500 as resistance as well as analysis of fund flows and investor opinion surveys.

There are 2 main scenarios here: either this rally is the first move up in a new bull market, or it is a middle/late stage glorified bear market rally. In either case, by historical comparison of past similar occurrences and their duration, % advance, rate of gain, etc, this rally is long in the tooth. Also, even IF this is a new bull market, the corrections after the first rally of a new bull market have tended historically to be very deep (about 75%ish) when the bear market was very severe (say 50% or greater decline).

If you are considering entering long-term investments, my suggestion is to not be fooled with all the recent media hype and technical excitement about the market regaining the 200 day MA, etc. Wait for a more substantial and longer duration correction and then consider if the time looks right.

Pete

US Dollar (and Euro) Video Update

This video walks through possible price patterns that are forming in the US dollar and Euro, with the main focus on analysis of sentiment data related to the US dollar and Euro.

In sum, a strong case could be made for a dollar bottom (probably long-term) forming or already formed. If so that would almost certainly lead to lower commodity prices coming soon, and also that deflation is likely the coming economic reality, rather than inflation.....but only time will tell.

As the saying goes for deflation "Cash is King." This is said because the value of your cash/dollars are increasing, while almost every other asset class is declining in value. So for most investors, the best bet is to just hold on to cash, though speculators/traders would have ample opportunity to profit from shorter and intermediate term swings.

Pete

Friday, June 5, 2009

New SDS Trade

I hope to get a video up before the close today, but for now, here is a new trade recommendation:

Buy SDS with a limit order of 54.00. Current price is 53.80 which I will use for blog entry price. This is strictly a short-term trade. No changes on the BGZ trade yet.

Pete

Thursday, June 4, 2009

Price Levels to Beware on Several Markets

S&P 500 cash value - 878.00

July Oil futures - 63.40

August Gold futures - 93.82

July Soybeans - 1110-00

July Corn - 442-00

I hope to get a video up tomorrow to show the importance of the location of Tuesday's high

in the S&P 500. Until 878 is exceeded on the downside, it is safest to assume the trend is still up. If new closing highs are made above Tuesday's high, there is no major chart resistance until the 1000 level, but from looking at several other related markets, I don't think that is most likely.

Wednesday, June 3, 2009

No Fill on SDS - Short Term Oversold

It will be key to watch how the indexes respond tomorrow and Friday. If they are able to accelerate down while short-term oversold, that would likely indicate that a top is finally in place. However, the S&P 500 really needs to drop below 880ish to put the nail in the coffin.

If price finds support above 900 and short-term technical indicators turn up, then I would almost expect one more push to a higher high before a top is made.

I will update on BGZ tomorrow, possibly suggesting an exit, but only if it really looks like another significant move up to a higher high is in store.

Pete

Investor's Intelligence Survey Update

It's been about a month since I showed this survey, but on account of the continuing large drop in bearish opinion among investment advisors, I thought now would be a good time for an update. As of today's data release, the bearish % is only 25%. That is as low as it has been since late 2007, around New Year 2008.

Additionally, while not part of the chart above, there are a relatively large number of respondants expecting a correction in the market. While extremes in the bullish or bearish % are good contrary indicators, extremes in the % expecting a correction actually seem to be a non contrary indicator, as the market has had trouble making intermediate term gains in similar past instances.

So in summary, the bullish % is not back at bull market levels, but an extremely low % of advisors are bearish and many are expecting a pullback. If you were to give me this data and only told me that the 200 day MA is sloping down with no other price info, I would say that we should have a bearish bias in the intermediate term just due to past history of this survey.

Maybe later in the week I will talk more about a composite view of sentiment surveys that combines the 4 most popular surveys (II, AAII, Market Vane, Consensus Inc) into one reading. For now though, as of last weekend's data the composite was nearing a relative bullish extreme in opinion. Even in a bull market that correlates with sub par performance looking ahead several weeks. In a continuing bear market, these readings give way to very negative price action over the intermediate term typically.

Now as an aside and unofficial list of some trade ideas or at least watchlists for those interested......

TLT - long trade in bond ETF

Pete

New SDS Trade Order

SPY is set to gap down this morning, and I don't want to chase the gap in this case. So I am going to suggest using a limit order that will require some move up from the open, but not a total retracement of the gap.

New Trade Recommendation:

Place a "day only" limit order to buy SDS for 53.44. This is strictly a short-term trade. There are no changes on the BGZ trade yet - just waiting to evaluate for an exit, a longer hold, or stop placement.

Pete

Monday, June 1, 2009

Video Update on Oil, US $, and S&P 500

Here is link to the January blog post regarding oil prices that I referenced in this video.

I may suggest a new short-term trade tomorrow because the short-term model became overbought today.

Pete