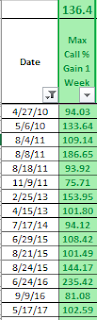

Click on Chart to Enlarge

In the past years I have made some note of key points when markets were at an apparent highs as evidenced by a break above one or multiple trend channel lines. Coupled with divergence patterns at the end of a parabolic type price movement, such breaks may be key inflection points.

The last time I recall making a mention of this on a larger scale was

March 2015 in the Dollar Index.

That did prove to be a key market high.

Currently, the Nasdaq chart above has some similar qualities in the strong run up since January 2016. Over the last week, price did break above a couple high to high trend lines connecting key highs over the last year and a half.

However, price is still 10% or so below a major high to high trend line connecting the key tops since the 2009 bear market lows. So, this may have some to blow off longer term to the upside.

But given the wide range bearish engulfing pattern at the recent highs, it seems likely to me that this week could be an intermediate high. The weekly price action formed an outside down day last week in the Nasdaq, and this is a classic top reversal bar.

Speaking of the US Dollar Index, which has trended lower recently as stocks have trended higher, the UUP etf made a major jump in volume today on a decent size gap down, and made a multi month low for the year. However, price reversed and traded to close near to the highs, forming a belt hold candlestick pattern.

This is couple with clear bullish divergence in the technical analysis of the US Dollar Index and I think indicates that the mid point of the year may be a turning point higher for the US Dollar. Commitment of Traders data show that the commercial "smart money" traders are more bullish than any time since near the lows prior to major rallies in 2014 and 2016. So there is still some room in that data before it becomes as extreme as those prior bottoming points, but my point here is that it appears close to a bottoming point and to be alert for long set ups if this is a market you trade in.

Back to the stock market for a moment.......I have looked at the recent charts of the CoT data of the index futures contracts and noted on a few of them, what from my experience and study is a pretty classic blow off move which signals a high. Basically, the commercial traders usually get more short on market rallies and the speculators get more long on rallies.

But currently over the last couple months, the opposite has occurred, indicating that the speculators "won" and forced the commercials into a short covering rally at which point the speculators have now cashed out rather than continued to follow the trend.

And from my study of the CoT data, this is the historical norm for the speculators to "win" at the end of key trends. So in actuality the speculators as a whole may be the "smart" money. Meaning that research into the topic, shows that speculators actually make the profits from the trading in the futures market. The commercials, are indeed experts in their market, but are using the futures as "insurance" and thus are essentially in the long hull, "losing" money akin to paying an insurance premium for their underlying business.

This pattern is notable currently on the Nasdaq futures contract, which adds further weight to the perspective that the recent top reversal type action in the Nasdaq is legitimate and may hold for several weeks or even months.

Pete