|

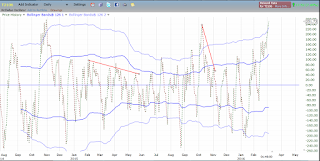

| VIX Hourly Chart with Bollinger Bands Giving Sell Warning for Stocks |

Today the rise in stocks coincided with a dual time frame VIX sell signal which I have highlighted many times here on the blog, with basically all being timely early warnings that a rally in stocks is ending. The easy money is made, and the downside risk outweighs the upside potential in the near term.

As noted above the hourly VIX closed below its lower bollinger bands on 20,2 and 126, 2 settings and the 20, 2 lower band was below the 126,2 lower band. What this means in short, is that the VIX is at an extreme low level relative to the longer term trend. This typically lead to some mean reversion or some type of smart money activity understanding the imbalance, and price halts its directional move.

|

| SPY gap down at 204 is now filled with extreme short term complacency in the options market |

Today's action in SPY filled the open gap down at 204 on SPY. This is the open gap down level which I had discussed a few times as the obvious target for the rally. Now as a side note, after observing action of individual stocks at support and resistance levels around large gaps, I have observed that a common mode of price action is for the gap to be completely filled prior to the final counter trend price move high or low being in place. So what often happens, is after the gap is filled, price reacts briefly (in this case it would likely lead to a brief sell off in stocks) and then price moves to a new extreme for the counter trend move which creates a more classic divergence pattern in the technical analysis and a more likely final high or low.

So in our case, this would suggest that SPY may briefly sell off here, and then rally up to new high for the move which would likely be in conjunction with stark daily time frame divergences in the MACD and other indicators. This would also, likely allow time for the weekly stochastics to cycle up to an overbought reading and create a dual time frame signal with weekly overbought, and daily overbought with bearish divergence which is a great sell set up in technical analysis.

I don't have a real strong opinion here as to whether the bull market is over or not, but there are multiple signs that the current trending move to the upside is about to stop and lead to some choppier action if not an outright downside reversal.

I will update with stats in the near future.

Pete