Today the VIX dropped over 20%. This has only happened 9 other times going back to September 1995. The forward results showed a very strong negative skew even in the short term of 3 days. That was slightly lopsided by a couple massive downers in October 2008, but looking ahead 2 weeks, 7 out of the 9 showed greater max losses than max gains.

So the point here is that we have the conflicting study from the last couple days, which suggested a rebound (which we saw already in some significant measure today) that may last several days. And now we have information suggesting that there is risk of immediate downside with 6 out of 9 instances closing lower 3 days ahead.

So if a call option was established with the expiration at this weekend, my current recommendation would be to exit ASAP, like at the open tomorrow.

I may provide stats on a possible put option trade if the rebound extends further from this level.

Pete

Tuesday, June 28, 2016

Monday, June 27, 2016

Backtests From Many Angles Suggest Probability of a Rebound Over the Next 4-5 Days

I have spent some significant time over the last couple days performing scans comparing the current market status to the past history in SPY. And from a number of different angles the stage appears set for a rebound in stocks.

The backtests have pretty consistently shown the 4-5 day forward time frame as having the most notable strength. So there are bullish plays here in both SPY options and the equity ETFs.

Now longer term, the results of the scans were not as consistent looking ahead 1-3 months.

My personal assessment from the technical side is that stocks still will fall a significant amount in the coming months. So the expectation may be for a short multi day rebound which will punctuate a continuing decline, and also may offer an opportunity to enter a bearish position on the rebound.

The backtests which I have run suggest that if SPY gaps down tomorrow, buying an ATM call option with the expiration at the end of the week would likely be a profitable play.

If there are any questions on specific ways to play this let me know.

Pete

The backtests have pretty consistently shown the 4-5 day forward time frame as having the most notable strength. So there are bullish plays here in both SPY options and the equity ETFs.

Now longer term, the results of the scans were not as consistent looking ahead 1-3 months.

My personal assessment from the technical side is that stocks still will fall a significant amount in the coming months. So the expectation may be for a short multi day rebound which will punctuate a continuing decline, and also may offer an opportunity to enter a bearish position on the rebound.

The backtests which I have run suggest that if SPY gaps down tomorrow, buying an ATM call option with the expiration at the end of the week would likely be a profitable play.

If there are any questions on specific ways to play this let me know.

Pete

Aug SPY 212 Put Limit Order Final Exit Acheived

The SPY 212 August expiration put which was entered at around 5.15 earlier this month, has now moved up in value beyond its 130% limit order which was the highest value given (at entry) as a possible exit limit dependent on position sizing.

So that trade is now closed. The equity portion of the trade has not quite achieved a 6.75% loss in SPY yet relative to the entry through another 1% decline would fulfill that limit order. It seems there is a high probability of that occurring.

The market is now set-up for a short term rebound and bullish play, I may offer some further stats on this later today or over the next few days as things unfold.

Pete

So that trade is now closed. The equity portion of the trade has not quite achieved a 6.75% loss in SPY yet relative to the entry through another 1% decline would fulfill that limit order. It seems there is a high probability of that occurring.

The market is now set-up for a short term rebound and bullish play, I may offer some further stats on this later today or over the next few days as things unfold.

Pete

Friday, June 24, 2016

Big Gap Downs Most Often Lead to Rebounds In The Coming Week

I will provide more stats after we see the close today, but with the big 3% gap down in SPY, a set-up is definitely in play for a rebound into next week. The backtest stats are good for both equity and option plays with expiration ending next Friday or exiting the equity trade next Friday.

So this is a heads up that a position may be taken before the close today. If there are immediate questions regarding possible positions, let me know ASAP to do some further back testing prior to the close today.

Pete

So this is a heads up that a position may be taken before the close today. If there are immediate questions regarding possible positions, let me know ASAP to do some further back testing prior to the close today.

Pete

Wednesday, June 22, 2016

VIX Increases With Elevated Put/Call Ratios

I ran a scan today looking back at times when the VIX increased more than 12% and at the same time, the total put/call ratio was greater than 1.05.

This back test resulted in a significant bullish skew in the SPY options over the upcoming 1-2 weeks.

When I added the condition of VIX/VXV being greater than or equal to 1.0, the results were even more outstandingly bullish. The results were not much different for bear market versus bull market moving average configurations.

So the implication here is that the market may rebound after the Brexit announcement.

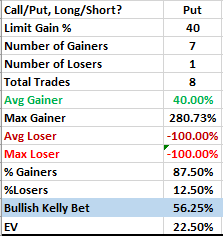

Buying an at the money SPY option with 1 or 2 weeks until expiration, and using limit exit orders of 40%, 60%, or 80% to exit while letting losers expire worthless all led to positive expected values. Since there are only 2 sessions left this week, I would suggest buying the July 1st SPY 208 call and using the 40% limit gain order would be an appropriate trade.

If further details are needed regarding position sizing, etc, let me know.

Pete

This back test resulted in a significant bullish skew in the SPY options over the upcoming 1-2 weeks.

When I added the condition of VIX/VXV being greater than or equal to 1.0, the results were even more outstandingly bullish. The results were not much different for bear market versus bull market moving average configurations.

So the implication here is that the market may rebound after the Brexit announcement.

Buying an at the money SPY option with 1 or 2 weeks until expiration, and using limit exit orders of 40%, 60%, or 80% to exit while letting losers expire worthless all led to positive expected values. Since there are only 2 sessions left this week, I would suggest buying the July 1st SPY 208 call and using the 40% limit gain order would be an appropriate trade.

If further details are needed regarding position sizing, etc, let me know.

Pete

Thursday, June 16, 2016

Rebound Suggested After the Open Today in SPY

In follow up to the information I posted yesterday, going back to late 1995 there were 44 instances where there were specifically 5 closes down in a row. And only 12 of them showed a gap down the following day. But the average open to close return on that day (today in our case) was 1.2% which is huge for these types of stats.

Now our environment is lower volatility, and I don't really expect to see that kind of a gain, but the suggestion here is that things are likely overdone in the short term, and multiday rebound is likely.

The 12 instances with gap downs showed about 2.25% return in SPY over the next 5-6 trading days.

Again our volatility is a little lower than others in this batch, but it makes sense that we could see a rebound into next week.

Pete

Now our environment is lower volatility, and I don't really expect to see that kind of a gain, but the suggestion here is that things are likely overdone in the short term, and multiday rebound is likely.

The 12 instances with gap downs showed about 2.25% return in SPY over the next 5-6 trading days.

Again our volatility is a little lower than others in this batch, but it makes sense that we could see a rebound into next week.

Pete

Wednesday, June 15, 2016

5 Days Down in a Row for SPY ETF 6-15-16

SPY closed down for the 5th day in a row today. Yet the sell off has been mild.

I ran a scan looking back at time when

I ran a scan looking back at time when

- SPY closed down for the 5th day in a row (not more or less)

- VIX high for the day was less than 30, indicating only moderate volatility

And the results had a notable bullish skew for the next 5 days. The best option profit opportunity was to buy an ATM call option with 1 week until expiration and set a limit order of 140% gain or let it expire worthless.

So, there are 7 days until the expiration next Friday. But most of the gains came in the first 5 days in past instances. So the way my model is constructed I would guess that the 140% gain would be a little too high to be realistic, but possibly 80-100% would be more realistic.

In any case, this set-up add further confirmation to the idea that a short term bullish rebound will likely occur into this weekend or beyond.

The strongest skew in the future equity returns occurred in the first 3 days, where the MAX gain was about 1.85 times the MAX loss. So there is a profit opportunity in an equal magnitude stop loss order and limit gain order.

If there are any specific questions on this let me know.

Pete

Back Tests on Days When the VIX Increases More Than 20%

Click on Stats to Enlarge

The VIX is an implied volatility index, based on actual option prices trading in the market. So a big jump in the VIX shows a real money indication of anticipated increased future volatility.

Monday was an interesting day in the VIX as the VIX jumped about 23%. That is not very common, but also is not the really interesting thing. What is more interesting is that going back to September 1995, where I have data to backtest, the VIX has never increased over 20% on a day where SPY was note down at least 1%. However, I looked for days when SPY was down less than 2% to give a sensible comparison, and the results for the next 1 and 2 weeks were both consistently bullish with good profit factors in both options and stocks.

I ran another simple scan which looked at VIX up over 20% but the SPY close was not below the lower bollinger band. About half of the days had SPY closing below the lower bollinger band. And the scan results are shown above for this scan. Notice the very consistent wins here - over 90% with correspondingly high expected values and Kelly Bet %.

So relative to Tuesday's open in SPY June 17th 208 calls, the option opened at 2.75. And so a limit gain of 40% would be about 3.85 as a limit order. There is not much difference at 4 or 5 days ahead, so choosing this week's expiration seems sensible.

If moving out to next week's expiration, the optimal limit order on the 208 call would be 80% gain. And the EV is only about 13% and Kelly bet is 16%

The instances where the next day, in this case Tuesday, closed down, 5 out of 8 closed up more than 1% over the following 3 days. This suggests there may be a tendency to rebound into the end of this week. So buying here could still be justified with a smaller position.

Pete

Tuesday, June 14, 2016

SPY August 212 Puts Hit 70% Target Limit Order

In a recent post I had suggested that a mix of expirations strikes or limit orders could be used to speculate on put option at the recent bearish set-up for SPY.

One of the options was the Aug2016 212 put. Entry price was 5.15ish. One of the limit orders suggested was 70%. That level was achieved today relative to a 5.15 entry.

Another limit order on this same option was 130%. The fraction of the account put into the trade would differ in each case based on past stats and optimal Kelly Bet position sizing. But if that order is in place, it still appears to have plenty of time to potentially hit the limit order.

Comment or reply if there are any questions regarding this position.

Pete

One of the options was the Aug2016 212 put. Entry price was 5.15ish. One of the limit orders suggested was 70%. That level was achieved today relative to a 5.15 entry.

Another limit order on this same option was 130%. The fraction of the account put into the trade would differ in each case based on past stats and optimal Kelly Bet position sizing. But if that order is in place, it still appears to have plenty of time to potentially hit the limit order.

Comment or reply if there are any questions regarding this position.

Pete

Saturday, June 11, 2016

SPY Put Option Exited for 40% Gain in 2 Days

The 40% gain limit order recommended for the June 17th expiration 212 SPY put which was purchased on 6-8-16 was already hit as of the end of the week. So far the option has increased over 50% at maximum from the entry.

Now the equity portion of the trade still has quite a ways to go in terms of price and/or time before an exit will be made based on the stats and orders suggested in the last post.

Additionally, if you purchased the August 212 SPY put, giving about 2 months until expiration, then the entry price was a little above 5.00, and the maximum price has hit about 7.00 so far. So the options is up about 33% so far. The suggested limit orders were 70% or 130% for this expiration.

Pete

Now the equity portion of the trade still has quite a ways to go in terms of price and/or time before an exit will be made based on the stats and orders suggested in the last post.

Additionally, if you purchased the August 212 SPY put, giving about 2 months until expiration, then the entry price was a little above 5.00, and the maximum price has hit about 7.00 so far. So the options is up about 33% so far. The suggested limit orders were 70% or 130% for this expiration.

Pete

Tuesday, June 7, 2016

Put Option Trade on SPY 6-8-16

Today was a potentially important day in stocks given the backtests which I ran today after the close of the market.

Here is a relatively simple scan:

Here is a relatively simple scan:

- VIX/VXV less than 0.86

- VIX up more than 2%

- SPY up more than 0.1%

Now the VXV has a limited history going back about 8 years. So we only have instances from the current bull market to judge. However, I ran the same basic idea and removed the VIX/VXV filter and instead ran added a filter of the 5/63 day total put/call ratio being less than 0.92. And the same approximate results occurred even with different days showing up.

Click on the Chart to Enlarge

This chart shows the summary of future returns for the next 6 months. We can see there are not many instances, but basically stocks had run out of steam and were set for a significant pull back over the coming weeks, beginning soon. The skew is very negative over the coming couple months.

As for the options there are profitable plays in several different strikes and time frames I am sure.

But I think the most sensible is the following purchase of an option.

Click on Chart to Enlarge

This chart summarizes the past results of buying an at the money put option with 2 weeks until expiration and setting a limit order to exit at a gain of 40% or letting the option expire worthless.

7 out of the past 8 instances hit the limit order making for a very nice opportunity.

In the current circumstance the closing value of SPY was more negative at 8 days forward compared to 10 days forward, so it indicates that the maximum gain was likely to occur within 8 days from entry of the option. So the option to purchase would be the standard June 17th expiration option. In this case I would go with the 212 strike put on SPY.

The key to long term success once a profitable method is obtained is to have as close to optimal money management as possible and to always stay "in the game". So my point here is that the above profile suggests an aggressive position is very justifiable. But if you use a simple % of account allocation on all trades, then there are many profitable orders. Buying 2 months until expiration and setting a 70% or 130% limit gain and letting losers expire worthless will also both provide profitable plays based on past stats, and allow for this month's expiration to pass if there is anything holding the market up through expiration.

So it may make sense to take the full position and split it into 2 parts, with half in the 2 week until expiration and half with a 2 month expiration 212 SPY put.

On the equity side, entering short SPY here and then setting a paired limit order and stop loss order of 6.75% or exiting after 2 months was a simple a nicely profitable trade. The expected value on SPY was about 3.5%. Stats allowed leverage of 3x on the whole account if using a triple leveraged bear ETF. So the return expected on the account would be about 10% expected over the next 2 months by using the 3x inverse ETF. This would be a more conservative play, but one that could be used in all types of accounts and provide a standout return during an expected downtime in the markets.

I know this post has a lot to sort through, so comment or reply if you have questions regarding the info or your situation.

Pete

Labels:

put options,

SPY,

VIX,

VXV

Friday, June 3, 2016

Shorter Term Bearish Skew in SPY

Relative to yesterday's (Thursday's) close in SPY, the scans I have been running of similar past conditions show a low volatility but definite bearish skew to the next few weeks.

There has been about twice as great MAX decline as MAX gain over the next 2 weeks based upon the set-up.

As far as the equity side of trading this market, one scan I ran suggested a paired limit order of 2.5% gain and a stop loss order of 2.5% loss relative to yesterday's closing price would yield about 0.71% profit in SPY over the next 2 weeks on average. Using a 3x leveraged ETF like SPXU, in theory would return about 2% assuming the whole account was placed in the bearish 3x ETF. The risk profile definitely justifies that position.

So from yesterday's close of 210.91 in SPY, the limit gain on the SPY short would be at 205.66 and the corresponding stop loss would be 216.25. Obviously if using a leveraged ETF those numbers would need to be adjusted for the fund and the leverage ratio.

But given the low volatility and forward negative returns in SPY in past instances, making 2% on an account in 2 weeks seems to be a reasonable play to me.

Pete

There has been about twice as great MAX decline as MAX gain over the next 2 weeks based upon the set-up.

As far as the equity side of trading this market, one scan I ran suggested a paired limit order of 2.5% gain and a stop loss order of 2.5% loss relative to yesterday's closing price would yield about 0.71% profit in SPY over the next 2 weeks on average. Using a 3x leveraged ETF like SPXU, in theory would return about 2% assuming the whole account was placed in the bearish 3x ETF. The risk profile definitely justifies that position.

So from yesterday's close of 210.91 in SPY, the limit gain on the SPY short would be at 205.66 and the corresponding stop loss would be 216.25. Obviously if using a leveraged ETF those numbers would need to be adjusted for the fund and the leverage ratio.

But given the low volatility and forward negative returns in SPY in past instances, making 2% on an account in 2 weeks seems to be a reasonable play to me.

Pete

Subscribe to:

Posts (Atom)