Click on Chart to Enlarge

A 4 hour chart of the Euro/USD shows sharp bearish divergence at the recent highs suggesting a multi day pull back in the Euro may have begun.

Click on Chart to Enlarge

The daily chart shows a mild intra wave bearish divergence on the daily stochastics. Not shown is the MACD which has a classic bearish divergence relative to the late Decemeber highs.

Click on Chart to Enlarge

The weekly chart shows a bearish divergence on the stochastics, suggesting this could be a larger time frame high as well. Also with price touching the upper bollinger band, it may be set for a top in a major down trend. Further rallies against the upper bollinger band, would be suggestive of a major uptrend.

Also notable on the chart is that the price is in an area of fibonacci clustered resistance at current levels. Additionally, there is a potential ABC upwards pattern that could be completing at the current price level.

This is a situation where a trade could be put on with exit of part of the position at the shorter time frame exit signal, and then begin a trailing stop strategy above resistance until the larger time frame exit signal comes.

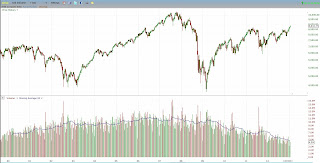

Click on Chart to Enlarge

The monthly chart of the US Dollar index is shown here with a possible large scale inverted head and shoulders bottom pattern forming. However, price is well below a possible breakout of the neckline, so there is no confirmation of a completed/valid pattern yet.

The smart money commercial traders in the CoT report are heavily net long the US dollar right now relative to other currencies, suggesting that currency traders be alert to a new major up leg in the US dollar. The maximum net long position by the smart money in the past has occurred prior to the ultimate bottom in prices forming a classic divergence, which could mean there is more downside here. But, given that the current signal is at a higher low than the previous signal, it is suggestive of a major uptrend in force and that the smart money views the US dollar value to be low compared to other currencies.

Click on Chart to Enlarge

The daily chart of the US Dollar Index shows a symmetrical triangle in the forming. Rather than guess at the direction of the breakout, one could wait for a close above or below the contracting boundary lines to increase the probability of successful identification of the new trend direction.

The last point I will note that may be significant (it has often been in the past) is that while stocks have moved to new highs above the September highs, the US dollar has not fallen below its Sept low. (Typically there is a negative correlation and confirming price action). The US Dollar Index has made a series of higher lows since the Sept bottom, which if accompanied by a breakout of the symmetrical triangle to the upside could suggest a significant rally for the dollar and a possible early end to the current rally in stocks.

Given historically typical legs up in stocks, it would be common for prices to move up into the mid to high 1600's before experiencing the next major correction. So that would probably accompany a downside breakout in the current US Dollar chart.