This is just a quick post for short term traders. In following the markets for years and seeing many times where there were large VIX spikes on a given day, corresponding with a significant market sell off, there is a pretty useful pattern that often occurs if the market gaps up the next day, like it is set to today.

If there is a gap up the day after a big VIX spike, the market will often experience a sell off in the morning that takes it below the yesterday's low, but then it often makes a morning or mid day reversal and may rally to close near where it opened or even well above.

So anything is possible, but I am watching for this pattern today to possibly trade long if the intraday set-ups are just right with nice intraday bullish divergence.

Tuesday, February 26, 2013

Thursday, February 21, 2013

US Dollar Index Breakout

2-21-13 US Dollar Index Update

This video covers the US Dollar Index and its breakout yesterday of a large triangle pattern. Also mentioned are stocks, bonds, and currencies.

Wednesday, February 20, 2013

Bearish Engulfing Pattern - Top Reversal in IWM

Click on Chart to Enlarge

IWM, the Russell 2000 ETF, formed a very wide range bearish engulfing pattern today. This is a classic top reversal candlestick, so we may be seeing an intermediate (on longer) term high here, but should likely expect some further downside in stocks. Looking at the MACD study below the chart we can see a sharp bearish divergence to go with the reversal candlestick pattern. So this looks legit as a reversal.

Given the overly optimistic sentiment I've discussed recently, this may be our cue that the market is entering a correction.

Tuesday, February 12, 2013

Ending Diagonal in IWM - This May Be "The Top"

IWM 30 Min

IWM is now displaying a larger potential ending diagonal triangle than the one I had recently mentioned and had suggested would likely lead to new highs.

Notice the current sharp bearish divergence in the 30 min MACD. That is a nice signal in a wedging pattern. However in context of a daily time frame MACD which also has bearish divergence in extreme overbought region, it creates a nice dual time frame set-up to potentially play for a larger move.

88.69 would be the minimum target on IWM if this is an ending diagonal and the MACD turns into a sell.

IWM Daily

Record net short position by commercial Russell 2000 futures traders and record net long by large speculators shows the extreme "bubble" which this market is experiencing. Additionally, Hulbert Financial Digest reports that newsletter writers are recommending about the same long exposure to the Nasdaq as they were at the peak of the tech bubble, with only that reading exceeding the current one.

So it is time to look to the short side of the market on a longer term basis here.

Saturday, February 9, 2013

Stock Market Update 2-9-13

Stock Market Update Video 2-9-13

This video covers US stock indexes, CoT data, technical analysis, foreign ETF's, US Dollar Index developing triangle, a harmonic trading pattern on EWA, and QQQ head and shoulders development among others. The price logic of the QQQ rally is such that it looks weak and corrective and likely will complete a head and shoulders top pattern.

Extreme Optimism and Non-Confirmations

Today I recorded a new video providing some analysis and projections with specific attention to several stocks that are perfectly set-up to experience major decline during the next market correction. Specific stocks shown are FAST, KMI, KMT, CMI, SBUX, NKE ,GE, SHPG, and the USD/CAD currency pair. I also put the price action of these issues into context of the forecasting information provided in my Trader's Crystal Ball eCourse.

The QQQ continues to develop into a possible head and shoulders top formation, which suggests a possible sharp downside resolution to its current trading range. Sentiment is also confirming the optimism that would be expected as stocks make a top, and also is displaying bearish divergence in several real money gauges of sentiment. In the video I cover the total put/call volume ratio and what it is telling us about the current market rally.

Collectively, commercial stock index futures traders have recently been forced to cover a build up of short positions from this fall. This week showed smart money commercial futures traders in stocks sharply increased their net short position. This is a possible indication that the short-covering process over the last 6 weeks is complete, and now we will experience resistance as the smart money provides new significant selling pressure on further highs.

The discounted enrollment period for my Harmonic Trading Stock Selection service will remain open through Sunday (tomorrow) giving a 19% discount. The writing is on the wall. If you want to profit on the downside of the market, this service will be invaluable to you over the near term. And when stocks are ready to move up again, we will position ourselves accordingly.

I look forward to seeing many of you come on board. If you have any question about the service, leave a comment or email me at pete@stockmarketalchemy.com

Pete Birchler

Thursday, February 7, 2013

Commodity Producer Stocks to Fall - Australia, Canada, Etc.

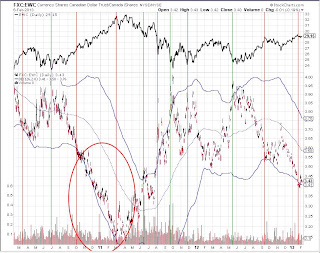

Click on Any Chart to Enlarge

Hopefully this will be followed up with a video, but the currencies have been not confirming the strength in stocks of Australia and Canada. Additionally, the US Dollar has not been weak as expected with the current US market strength. The charts above show that when the currency to stock ratio becomes extreme as indicated by the Bollinger band configuration above, inflection points are typically near.

So expect a correction in these markets. Additionally there is daily time frame technical divergence coupled with over zealous bullish sentiment (historically so by several measures). So the picture fits for a correction.

Wednesday, February 6, 2013

Bearish Divergence in Stocks

Click on Chart to Enlarge

This is an hourly chart of SPY. There is a strong bearish divergence on the MACD present at yesterday's slight new rally high. The chart has the look of a very short term double top. The indexes are set to gap down this morning, and a cross of the MACD may initially target Monday's low, but a break of that low would give a target to around 147.50 for a textbook double top projection

The daily chart is showing a building bearish divergence in the RSI with prices near the upper Bollinger band. A multi day pullback may offer another nice short-term long trade set-up.

Foreign stock indexes cracked harder on Monday than the US. And the rebounds were weaker yesterday. They look like they could still fall a good bit even in the short term.

Tuesday, February 5, 2013

New Video Available - AAPL, SBUX, QQQ

Last night I recorded a new video providing some analysis and projections with specific attention to AAPL, SBUX, and QQQ. I also put the price action of these issues into context of the forecasting information provided in my Trader's Crystal Ball eCourse.

The QQQ continues to develop into a possible head and shoulders top formation, which suggests a possible sharp downside resolution to its current trading range. Sentiment is also confirming the optimism that would be expected as stocks make a top, and also is displaying bearish divergence in several real money gauges of sentiment.

Collectively, commercial stock index futures traders have apparently been forced to be covering a build up of short positions from this fall. While it may take weeks for that process to unfold, and typically lead to some further upside in stocks, the various indexes are mixed with the Nasdaq having already greatly reduced its short position to neutral on the Sept-Nov decline. Once the commercial short-covering is complete in other indexes, we may see a sharp market correction.

I have re-opened a discounted enrollment period for my Harmonic Trading Stock Selection service in light of several outstanding current opportunities, and the anticipation of a possibly significant trend change if the Nasdaq completes its head and shoulders top. Details are in the video as well.

Pete Birchler

The QQQ continues to develop into a possible head and shoulders top formation, which suggests a possible sharp downside resolution to its current trading range. Sentiment is also confirming the optimism that would be expected as stocks make a top, and also is displaying bearish divergence in several real money gauges of sentiment.

Collectively, commercial stock index futures traders have apparently been forced to be covering a build up of short positions from this fall. While it may take weeks for that process to unfold, and typically lead to some further upside in stocks, the various indexes are mixed with the Nasdaq having already greatly reduced its short position to neutral on the Sept-Nov decline. Once the commercial short-covering is complete in other indexes, we may see a sharp market correction.

I have re-opened a discounted enrollment period for my Harmonic Trading Stock Selection service in light of several outstanding current opportunities, and the anticipation of a possibly significant trend change if the Nasdaq completes its head and shoulders top. Details are in the video as well.

Pete Birchler

Monday, February 4, 2013

Stock Market Update 2-4-13

Stock Market Update 2-4-13

This video is a stock market update covering the S&P 500, QQQ, EWA (Australia etf), among others. Pattern time cycles are noted, technical indicators are reviewed. Price action suggests that the US markets may experience some further upside which may become more choppy and volatile in coming weeks.

Subscribe to:

Comments (Atom)