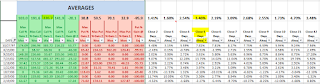

Click on Stats to Enlarge

Tonight I ran some stats as a follow up to the previous post, this time looking at similar set-ups to this past Friday's when the following trading day gap (in this case Monday) gapped down.

The stats are solidly positive again with 80% or more of instances showing gains greater than 50% on the ATM option from the signal day's close. But the option gain stats above are all relative to the signal day's close. So if you actually wait and buy on the following day's gap down, then the gains become even bigger. There were some monster trader wins in this list.

The historical evidence still solidly points to buying a call option with a week until expiration tomorrow morning with the strike price somewhere in the region of Friday's close or Monday's open.

If you go back through the charts and look at the instances when the following day gapped down and then price closed above the open (and the higher the better), it made sense to hold that option for the next 5 days rather than sell right at the 50% gain. But for simplicity, I would add to the last post that buying a SPY Aug 28 expiration call option tomorrow morning at a strike around Monday's opening price, and setting a limit gain of 50% for the exit, should be a solidly positive expectation trade.

Looking at the following day gap down of more than 2%, every trade out of 7 instances showed a return of 50% or greater gain on the ATM option bought at Friday's close. And the average close on SPY 5 days later was +4.96%. Buying at the open of the gap down the following day would have shown an even larger gain obviously.

So the indications here are clear that this gap down into Morning is likely to be an exhaustion of the move. Something new can always happen, but with a correctly or comfortably sized position, with defined risk such as a call option, I feel that I HAVE to take this trade regardless of how wrong it feels because the market is free falling down.

I will assess this in the morning but likely buy an ATM option with an expiration this coming Friday, August 28th. Assuming the trade unfolds in a massively positive direction, I would suggest using a 5 minute or 15 minute MACD chart to look for a bearish divergence to exit the trade prior to expiration.

Futures are down 4% this morning (Monday). This is just an amazing and rare type of action. Same comments apply as in the post above.

ReplyDeleteGot in with a 197 call on a limit order of 0.70 at the open.

ReplyDeleteHave a 3.50 limit order to sell for today.