|

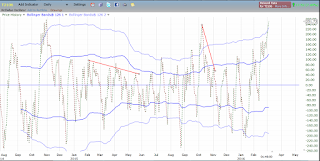

| NYSE McClellan Oscillator |

Click on Chart to Enlarge

The chart of the daily McClellan oscillator shows breadth hitting new peaks on recent highs. This is strongly suggestive that the rally will make further higher highs before reversing.

So it doesn't necessarily mean that it will have a lot higher to rise, but in my observation of markets over the last decade, there almost always is a bearish divergence development in this indicator before a meaningful top occurs, even in a counter trend rally.

So, at this point I would expect the next unfilled gap down at about 204 on SPY to be tested before this rally would be likely to stall out (if it even does stall out and lead to a major correction).

I will run some scans over the next week to help quantify the risk reward of potentially shorting or speculating on resumption of a larger downside in the upcoming days. But I would not jump the gun here as far as speculating on the downside. Let it play out. Let some divergences develop and let the sentiment and breadth show in definite terms that a typical topping type action is occurring.

I will update as it unfolds.

Pete

No comments:

Post a Comment