Wednesday, August 26, 2009

New EUO Trade

The chart above is EUO which is a 2x US $ dollar bull fund. The rationale for this trade can be found in prior videos and charts on the US $.

In this particular case, I have considered making a new attempt at an inverse trade on the stock indexes, but as shown in recent posts, I don't know if the timing is right. However, the yesterday DIA, QQQQ, and IWM all showed dojis, and SPY showed 2 long upper shadows in a row. Coupled with extremely bullish sentiment and bearish divergence among many technicals, the market could be topping any day.

In past market downturns over the last year or so, the dollar has often started higher even as stocks were still making higher highs. Along with the VERY extreme bearish sentiment on the dollar and a pretty clean pattern with bullish technical divergence, I think even if the market continues higher, the dollar may be starting higher. Also note the short term reverse head and shoulders type pattern that may be forming on this 60 min chart.

New Trade Action:

Buy EUO with a market order today 8/26/09. The current price is 19.13 which will be the blog entry price. Place a GTC sell stop at 18.70 immediately after entry.

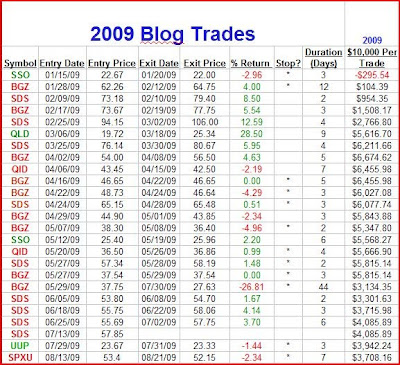

Updated 2009 Closed Trades

Click on Chart to Enlarge

Click on Chart to EnlargeThe $10,000 Per Trade column simply shows the running profit/loss from putting exactly 10K into each trade. The Stop? column has a star if the trade was exited by being stopped out.

Tuesday, August 25, 2009

Colgate Technical Analysis

Colgate, CL, is a stock I have watched for a long time. I have traded it a couple times, but don't have any current trade on it. It is showing an ideal longer term position trade short sale set-up right now, so I though I'd bring it to the table and tie a few technical things together as well.

First off notice the breakaway gap down off the most recent peak. The gap was large for this stock, and occurred on the heaviest volume in over a year. This happened right as the stock completed a retracement of last fall's crash to challenge the highs.

Now it's been basically a month since the gap, and while the market has made higher highs it hasn't. In fact, at no time since the gap has price traded back above the open of that gap down. This shows weakness in the buying interest. Most successful breakaway gaps don't get completely filled, so the longer price chops in this zone, the higher the chance it is a major trend changing gap down.

The blue box represents the time consumed by the moves I have labeled A and B. Now the actual labeling is not what I'm trying to show here, though it does appear to be a corrective type pattern. The point is that I find that one of the most reliable topping time frames for a pattern like this, is for the C leg to take the total amount of time as A and B combined. While CL meandered a bit higher after that for a week or so, sure enough, it showed the already mentioned gap down near that time frame to help confirm that it was following that time relationship.

There is a stochastics chart above showing that it has had time to become overbought after this gap down. Also, not shown is the weekly chart in which the stochastics has just turned down out of overbought territory. I like using stochastics on multiple time frames and look to time entry on a larger scale pattern with the next lower time frame.

Also, notice the increasing volume at major breaks to new trend highs up through the middle of wave C, then the waning volume from middle to end. That is not so important now, but is important to learn for evaluating a move as it is occurring.

For trading purposes, I would short this right here with a stop just above the 76.00 level. Now I wouldn't expect it to drop hard right away, but I know from experience with breakaway gaps that it may not have much upside left, and the reward profile is good even entering now. I have shown support levels that could be used to scale out of part of the trade assuming it went down from here. Also as each target is reached the stop on the rest of the trade should be moved down in some fashion to lock in increasing profit on the rest of the position in case it doesn't continue down.

Ultimately, if this proves to be a major inflection point, I would expect prices to fall at least marginally below the October and March lows, which may be the final level at which to scale out if that level is reached. It would take several months for this to occur, but for longer term traders, you may want to look into this further.

Monday, August 24, 2009

S&P, VIX, and Shanghai Dow

Since the market made higher highs, I think the best way to view the pattern in the S&P is in the last leg up of a triangle pattern. It is following pretty close the green projection line from this prior post. I am certain that many traditional Elliott wavers view what I have labeled as C, D, and E? as and ABC or a W-x-Y-x-Z up from the March low. In any case, I think the Elliott wave experts generally agree that a major top is close at hand.

From the "looks" of it, I would say the market will probably push modestly higher for a couple weeks. However, from a technical and sentiment perspective, I believe the stage is already set. It is just a matter of seeing a larger, faster correction than any during this advance since March to confirm that a larger degree top is in place.

DMI and Aaroon show reasonably strong trends in place, but basically every single daily oscillator is blaringly divergent on this move to new highs. Coupled with the post crash high at 1044ish and a doji in the cash S&P index today, it certainly would not surprise me if the market makes no further head way from here.

The chart above is the VIX. Many will note the divergence in the VIX not making new lows as the indexes make higher highs. That has occurred several times on this rally, without meaning too mcuh. Although it does look different this time in that the VIX is basing at the 25 level rather than trending down or making quick sharp spikes up. The green lines indicate the wedge that many are watching to indicate a possible breakout to the upside in volatility.

The is the Shanghai (Chinese market) Dow. I show this simply for the fact that it has been leading our indexes at tops and bottoms for more than a year, and also because based on some historical comparison to our market, what happened here might be what we should expect in our market.

In July our market shot way up and trended extremely tightly for a few weeks. The precedents similar to that kind of complete lack of mean reversion for that long, basically showed markets that were able to continue higher for several weeks, but then had most or all of the gains of that trend erased in sharp corrections. In the case of the Chinese market right now, this played out as well. All the gains from early June to early August were wiped out in about 2 and a half weeks.

In sum, as it stands now for longer term traders, I would be looking for entry any time on bearish trades. If you are holding bullish positions, then I would definitely suggest having stops in at last week's lows and also consider trailing them in some fashion if the market does move higher in coming days.

For shorter term (swing style) traders (excluding day traders), I would either avoid any new bullish trades, or only enter if there is a pullback this week that holds above last week's lows. And use those lows as a stop. For the top pickers (myself included) I would jump on any classic top reversal candlestick patterns with stops above the high of the pattern.

Sunday, August 23, 2009

Deflation vs. Inflation and Some Intermarket Relationships to Consider

For today I wanted to discuss a more leisurely, but also more important, topic especially for those who are at or near retirement, or who have a significant amount of wealth in the financial markets in one way or another. I will try to give a sensible macroeconomic view of what is occurring in the markets with regards to deflation, and try to give some ideas on how to protect your wealth during such an environment. I will try to keep the narrative to a minimum, but I know from experience that unless you have very actively sought out information about some of what I will be talking about regarding our monetary system, that you were almost certainly never taught this in any educational setting, and you will likely not have an actionable understanding of it, if relying on mainstream news type sources for your information.

First off I don't think most in our country have ever put a lot of thought into what "money" is. But dollar bills are obviously not valuable in and of themselves. Also, you cannot even legally exchange a dollar bill for any tangible good from the US Treasury (like gold) anymore. So what is a dollar worth? What IS a dollar? In short, all our dollars are notes of debt. They represent the debt of our Treasury, and is only backed by Treasury bonds purchased by the Fed (bonds also being debt). So a dollar is actually a credit. You are a creditor to the govt. and the dollar represents that. So dollars are probably not best viewed as "money" because they are not real, tangible goods.

Now many people also don't have much clue about how our monetary and banking system work. It is not taught in schools, etc, and I think that is intentional at some high level, because if we all understood it, we probably would see the insanity of it and such a system would never work. So as a brief lesson.......

Our government issues bonds (debt) that the Fed has to buy legally as our central bank. Then the Fed can print actual paper notes (dollar bills) backed by those bonds which represent that debt. If it stopped there, then that is not too hard to follow, but the system has evolved on a legal basis so that that paper money is only a fraction of what I will call the "money supply".

Money Supply = dollar bills + credit

The term for our banking system is called fractional reserve lending. A bank only has to keep a small fractional amount of cash (used to be 10%, I believe) as a reserve against the total amount of loans the bank makes. So if the bank has a million $ bills, then it can have about $10 million in loans or CREDIT all backed by that $1 million. This is great for banks for a while because instead of collecting interest on the loans of their assets which is only a million, they are collecting interest on $9 million extra. So the point is that what you or the next guy typically call "money" is paper dollar bills. But that is only the part of it. The rest of the "money supply" is credit in the form of loans. (Also, it is acutally worse than that, in that as laws have evolved and greed has overtaken sound lending, that there is actually net negative cash reserves compared to credit extended).

So how does that relate to inflation and deflation? Quite simply you can view inflation as any time that the total money supply is increasing, which results primarily from low interest rate borrowing, and abundant lending which increases the credit portion of money supply. Then you can view deflation as any time that the total money supply is decreasing. This happens not because dollar bills disappear. What disappears is the credit again. This occurs due to decreased lending and borrowing. Quite simply, "money" that comes out of the ether can return to the ether at some point in time. It is this "fiat" aspect of our "money" that most of us don't understand, are not educated on, and why the periodic deflations of history surprise and confound almost everyone in the masses.

So keeping it short, the economic environment that we are currently in is one of fundamental deflation. Consumers, the private sector/business, and government are all indebted to the max. Now many are beginning to default on loans. They borrowed but they can't pay it back. So what happens? Well, all the dollar bills are still here, but the credit of that loan now has to be dealt with. The end result is that a credit that cannot be paid back, must disappear. This is happening on a massive scale in the housing industry. Credit in the form of home loans is disappearing from our money supply as more and more people default and the reality sets in that whatever "value" was represented by that loan is no value at all.

Now, despite the ignorance, or more likely deceit, of those like Bernanke, et al, who testified that it was unlikley that the subprime housing defaults would filter down to the economy at large, the hard numbers seem to scream that it has and it is not done. The subprime defaults are only a portion of the total loans that are currently non-performing. A non-performing loan is one that is not being paid by the borrower. So there is obviously a greater problem and risk of credit default and total money supply contraction than just that subprime issue.

Without going further, I hope this small illustration helps get the picture of what is going on here. Despite popular wisdom that the Fed or govt. is "printing money" and that that will surely lead to inflation, understand that any of that printing or monetization that is occurring is a lesser force than the astronomical amount of credit that will simply disappear due to default when everyone has to show their cards. And that last phrase is important, because to date, the banking industry as a whole has not had to show their cards. If they did, then we would all see that some loans are not performing and that credit would be wiped out. Because of the amount of leverage these banks have, that would bankrupt MANY of them (from my understanding of the average numbers - if only about 5% of loans are completely defaulted in a bank's portfolio, then that will wipe out all the bank's actual assets since they may be loaning out 20 times the amount of their actual cash assets).

So this whole bailout notion seems to me, to have been a HUGE gamble, of trying to create credit via govt. selling bonds which the Fed buys, then basically distributes into the banking system at close to zero interest to the banks taking the money, in hopes that the new credit will be used to loan people money and in turn create even more new credit, etc, etc. Well unfortunately, we as a country are at the wall in terms of debt. The cat is already out of the bag, that many home loans will default. And greedy banks may be, but completely stupid they aren't. They are not going to loan to people now, when it is obvious to everyone that there is a big risk of those loans defaulting, not too mention that fewer and fewer people have jobs to pay back loans, and asset values have diminished as well.

So despite the unprecedented attempt at credit creation, it amounts to a redistribution of money from us taxpayers to banks who are too smart to loan it, but are desperate none the less to try to "earn their way" back above key reserve levels before they are forced by Congress to show their cards and say that "you can't keep pretending that those loans still exist and have the stated value". So, what do the banks do? Sell newly created shares to the public/etc. then speculate like mad in equities (up to this point = BUY BUY BUY) with this freebee money to try to profit as well as boost the value of their own shares as the market rises.

If you think the last paragraph was an oversimplification, you may be right, but probably only a little bit. I really think if you were to have full disclosure and "follow the money", then you would see that what is above is closer to truth than not.

For a brief summary then, what we currently are seeing from actual hard numbers on economic activity and data relevant to money supply, is that confidence is returning to the public and monetary system, but the actual underlying credit contraction has probably just started in the last few months. Now the point, is that the entire system could not work without confidence. But that is not sufficient. There is a mathematical and psychological reality that sets in at a certain point, where the credit has to contract and return to the ether. As a herd we only remain confident so long before we face the facts.

It is this very return to confidence in the face of reality, that is a fundamental tenant of wave theory regarding financial markets. In this case I think we have seen an initial phase of realization and panic regarding debt and credit. Now we are in the midst of (and I think near the end of) a reactionary phase of relief and hope that the worst has past. Large scale psychological trends of this nature tend to unfold in 3 or 5 phases in wave theory. It seems like we are done with a first and about done with a second (an A and a B, or a 1 and a 2) phase of this typical pattern. With history as a guide, the 3rd phase and beyond are when it hits the fan.

So that is what I believe is the factual and psychological reality. Maybe you don't believe that, but if you haven't spent some legitimate time trying to understand the situation, then it may be in your best interest to do so FAST.

Now on to how to actually protect wealth in a continuing deflationary environment.....

First off, with history as a guide stocks will get killed. And regarding that, earnings have fallen so far in relation to dividends, that dividends are more than earnings as a whole. So unless earnings improve dramatically and pretty quickly, expect to see dividends being cut by many companies in the not too distant future. So the coupled prospects of capital loss and cut dividends probably make stocks a horrible choice.

Contrary to what might be conventional wisdom, bonds got beat up badly in the 1930's deflation. Understand that bonds are debt and that a deflation is basically a massive debt default. Many low grade bonds go under completely. And fear of default pushes prices lower on many bonds that make it through. So, staying in or increasing bond exposure will almost certainly not be wise. There are different types of bonds (corporate, municipal, Treasury, etc) and not all will be the same, but across the board, the lessons of past deflations are that most bonds will decrease in value and some may default.

Many think gold might be a good way to go. From my understanding, gold tends to rise most correlated with economic growth (which also correlates strong with inflationary or credit expansion periods). So a deflationary period is the opposite of that, so I wouldn't expect gold to gain in value on a historical or a theoretical basis. Not to mention the historically ultrabullish sentiment on gold in 2008 as a long term contrary indicator. However, I personally would choose investing in gold over stocks or bonds in this period if a gun was to my head. After all precious metals have been tangible money for a few thousand years.

Hopefully you put 2 and 2 together from the discussion above, but in a deflation, the dollar bills are still there, but the total value of the money supply has lessened substantially due to credit default. This makes the value of actual dollar bills increase on a relative basis. This coupled with the fact that economic demand and hence prices of most goods and assets fall, your dollars will have greater purchasing power as well. This makes the dollar my vote for the safest investment for the foreseeable future. Actual physical dollar bills are probably the safest, though deposits at a safe bank or another form of cash balance, etc. may be fine as well. In addition, there are ETFs or Rydex funds that can be used to get exposure to the greenback.

There are other options to consider as well like short-term Treasury bills, or foreign bonds, etc, and you may want to look into those, but I will not give guidance on that. Above all realize that keeping the money you make is a respectable achievement. Additionally, imagine the opportunity maybe 3 or 4 years down the road, if stocks are down 2/3 in value and gold by 40 or 50% and quality bond yields are in the double digits. So just maintaining current cash values for a couple years can put you in a good position when things bottom out.

For reading material, Robert Prechter's Conquer the Crash should be a good place to start. Peter Schiff's Crash Proof is also pretty good, though they certainly aren't coming from the exact same perspective. If you are dealing with relatively large sums of money and have conviction, then you could look into a professional organization such as SafeWealth.

Now, history also teaches us that despite the best efforts of intelligent people to tie up all the loose ends and figure things out, unexpected things happen. One particular thing that is a major wild card in my mind may be completely unheard of to most. But, in the same way that Europe was reorganized into a "European Union/Community" with a common currency in the Euro, the powers that be have for quite some time been working towards actualizing a "North American Union" (US, Canada, Mexico) with a common currency that is tentatively referred to as the "Amero." So in the event that economic catastrophe is used as an impetus to further such globalization interest, I really have no idea how that would affect the dollar or other currencies. In fact, I don't even know much at all about how the implementation of the Euro affected European currencies, so any readers knowledgeable on this subject, please refer me to some literature, etc.

Most people are not motivated to protect wealth until it is all but gone. I hope that everyone reading this doesn't fall into that trap. Also, the fact that your holdings may be down 30 or 40% from peak values is irrelevant. That is the past. Your job is to do the best with the future. So I encourage any and all of you to do your due diligence in this regard. Like it or not, money (and those who control supply) run our lives; maybe you don't have the time to educate yourself enough to confidently make major changes in your investments, but you need to consider the alternative.....

Friday, August 14, 2009

SPXU Optional Stop Adjustment

I am not going to change the blog stop yet, because so far the trade looks good, and I want to allow the trade as much room as possible to work out, particularly since there is some chance that this week could be a MAJOR market high, with a very high reward vs risk potential for this trade. Then if the market breaks the first minor support at this week's lows, I will definitely move a stop to breakeven or better.

Thursday, August 13, 2009

New SPXU Trade

The chart above shows SPXU over the last 8 days or so. SPXU is a newer 3x ETF mirroring the S&P 500. It has caught on in popularity and has good volume. For any potential 3x trades I will probably use this from now on to try to avoid some of the problems with my analysis being on the S&P 500, but trading BGZ which is based on the Russell 2000. The slight differences in performance make placement of stops, etc more tricky.

The chart is showing a possible head and shoulders bottom developing (a H&S top in the S&P 500) on a short term basis. Now it would be safest to wait for the neck line to be exceeded, but that will significantly diminish the reward to risk ratio. So I am going to post a trade on it with an entry at current levels. There are mre than enough factors to justify this in my opinion. So ideally the market will fall over the next couple days and we can move a stop to breakeven quickly with possibly a MAJOR market move on the horizon. If not we will probably be stopped out. So make sure that your risk is sensible. If you have any questions use this post to decide how much to risk on the trade. Use the "Trades with a Stop Loss" section.

New SPXU trade:

Buy SPXU today with a market order. Place a GTC sell stop at 52.15 immediately after entry. Blog entry price is the current price of 53.40.

For any smaller accounts that would be following the cumulative method of money management and still holding SDS, just continue to hold and forget this trade. I will either post an exit on that at the next oversold signal, or start to trail a stop if the market appears to be making a major top.

Follow-up Video Update

I made a follow up video today to cover a few things I didn't in the last one. From the most recent data and today's FOMC announcement, I am not sure the market has another few weeks left in this rally. So I wanted to show a bunch of charts so that you know what I am seeing.

I had intended to put a short comment on the FOMC meeting at the end of the video, but there was an accident involving my finger and the "s" key which stopped the video, and I didn't feel like making another one. In short, the statements made seem to clearly indicate that the quantitative easing (massive treasury buyback currently in force) will end in October and the remaining treasuries to be bought will bought over that time frame, which is a slowing of the rate of buy back from my understanding.

Since the FED announced this policy in mid-March, the dollar has gotten hammered. Almost certainly there are many who expected them to increase or extend this program, which would further weaken the dollar. Now that it seems clear they won't, a major fundamental to the dollar's demise appears removed for the near future. I believe this will likely be bullish for the dollar on a fundamental level. That supports the bullish price pattern and extreme bearish sentiment currently.

This would also be bearish for stocks as noted in recent posts. I would anticipate that it would be bearish for gold as well. Since the purpose of that program was supposed to be to keep interest rates low for housing, yet the rates have increased substantially during this buyback, it would seem that the program was a failure (other than a huge equity pump). Now I wonder, if this unprecedented rate lowering external force is removed, will rates explode upward?

Also, there seems to be some indication from the chair of the Congressional Oversight Panel, that they believe that it is necessary for the fraudulent accounting practices that banks are currently using to avoid realizing losses on the books, need to be stopped with a return to mark to market rules. Well that's a step in the right direction, though it is obvious that such accounting fraud has occurred for quite some time, and is still occurring. All these thiefs need to go to jail including Paulson and the rest who orchestrated the theft of our dollars through fear mongering and then directly put a huge amount of that into the banks, who still haven't had to realize the loss from those "toxic assets." Also the FED should go, who monetized debt when they testified to Congress that they would not. So, while nothing has changed yet, if the COP do what they know needs done, then there could be a return to mark to market, which I have to assume will hammer many financial institution and destroy others. In any case, I think there is a real possibility that there may be market moving policy/regulation changes in the near future.

Sunday, August 9, 2009

Video Updates - US Dollar and Equities

The videos cover the US Dollar and stocks. I used a video capture program that I haven't used before, and the video quality doesn't look that good, but Oh well.

During this bear market, the dollar has tended to turn up before equities top out, so even if the dollar has bottomed, there may be a period of a few weeks before stocks reach their peak.

My suspicion is that this week may see some sparks fly. There is an FOMC meeting I believe, and also there are multiple bond auctions yet again. Much of the Fed's game plan (assuming the goal is what we believe it to be - growth, economic expansion, etc) relies on keeping interest rates low, and conversely bond and treasury prices high. This is at the same time as the Treasury is flooding the market with auctions for treasuries securities to fund debt/federal obligations. So the Fed has to fight supply and demand as well - try to keep the prices up while supply is being driven up enormously. So the point is, that while these auctions have been occurring regularly recently, it is arguable that the most recent auctions have shown waning demand. This would result in buyers requiring higher yields on the debt they are buying (which would equate to a higher US dollar value and lower bond/treasury prices).

As another side note, the Equity P/C ratio came in very low at 0.49 Friday in conjunction with a spinning top candlestick and a gap up on monthly payroll data which has tended to result in give back of the gains over the next couple days. Readings that low in the P/C ratio have consistently led to negative next day returns. Also, this is basically the lowest reading of the bear market, so this may be an indication of maxing complacency. In addition the VIX has not confirmed the recent move to new highs in stocks, and several sectors did not confirm the indexes to new highs the last few days. So on at least a short-term basis there is divergence and complacency which I expect to lead to a decline larger than the miniscule ones since July 8th.

Thursday, August 6, 2009

S&P Outlook

Most of the notes are on the chart and build on recent posts. I am still waiting for a legitimate oversold signal to exit the SDS trade. I would actually be interested in a bullish trade if the general outline of the bold green line above plays out. That would be a pullback to near the 950 breakout level with short-term oversold conditions.

The most recent real money sentiment readings are starting to get to the level that even in a bull market you expect some give back or a slowing trend followed by a quick give back of gains. From a technical perspective, I would guess that we will have to see some divergences in breadth and momentum indicators occur before any large correction would begin though. Also, as per yesterday's post, at this point I would almost assume that every last post-crash short will be squeezed on this move, which should allow the S&P to move up another 4% from current levels before the juice is gone. Not saying that will be right away, but maybe over the next few weeks.

Once again, the markets closed well above the morning lows. Out of SPY, DIA, and QQQQ, only QQQQ managed a bearish engulfing, and it had a tail under it, so I opted to not post a trade. First I want to have more confidence from the price pattern that the market really may be making an intermediate or longer term top to post a 3x trade. Right now, though the sentiment picture is getting overly bullish, I don't have that confidence, so it probably will be smartest to just let any pullback occur, and first judge whether it is buyable or not.

Wednesday, August 5, 2009

Quick Heads Up

The Big Squeeze

It's late and I don't have a lot to say. I made this chart yesterday but didn't post it. That is how I see it. I am willing to start betting against this rally on any legitmate candlestick reversal pattern. Given the notes above, I have serious doubts about any bullish activity above 1050 on the S&P cash. I haven't got around yet to doing a video or major chart blitz review of current data, partially because if this week is an uptrending week, I think the data will be that much more telling this weekend.

In short, dumb money confidence is back at the highest levels of "the bear market" and smart money confidence is back near the lowest levels. From a long term wave theory perspective, the next move down is likely to be either horrible or really really horrible, both in the markets and in a broad economic sense. Other than the primary goal of this blog which is the nuts and bolts of making money very consistently with short-term trading, the second focus I have had is on making sure that nobody reading this gets their life's savings wiped out in this mess - or at least that I did my best to make sure that didn't happen. It takes courage to go against the crowd. It takes courage to click "sell" again when the market goes up another 5% the next week. But with each day the market move higher here, my opinion is that we are getting one step closer to "the day when the buying stops."

There are two ways to make money: #1 is to make money, #2 is to not lose money.

I just hope that everyone is not so focused on #1 that you don't do some serious planning on #2.

Pete

Monday, August 3, 2009

Buying Breakouts - Part 2

I have been trying to temper my longer term bearish outlook with some lessons and trade ideas on quality growth stocks in recent weeks. Even if the market does make new bear market lows in the future, the current rally has been large enough and lengthy enough to be classified as a bull market in its own right. There has been plenty of time for stocks to undergo basing periods since March, and add to that the huge number stocks that did not confirm the new lows in the indexes in February and March. So quite a number of quality issues have been basing since Nov 08.

I have been trying to temper my longer term bearish outlook with some lessons and trade ideas on quality growth stocks in recent weeks. Even if the market does make new bear market lows in the future, the current rally has been large enough and lengthy enough to be classified as a bull market in its own right. There has been plenty of time for stocks to undergo basing periods since March, and add to that the huge number stocks that did not confirm the new lows in the indexes in February and March. So quite a number of quality issues have been basing since Nov 08.From looking at tons of charts in recent weeks, and particularly the last 2-3 weeks, it appears that many stocks are forming or have broken out of 2nd stage bases recently. For those who are not familiar with the concept of "bases" or the staging, I am referring to it as in IBD literature. A base is a period of organized consolidation in a stock price at which point many shares are aquired in a fairly narrow price range by institutional traders. These bases typically have a rounded or flat bottom rather than a V shape. There are a few classic basing patterns that show up again and again before major moves in stocks. The importance of recognizing these bases is that big moves in stocks typically occur in short periods of time right after they breakout of a base. So if you don't recognize the base before the breakout, then you often are late to the party on buying.

IBD literature suggests that stocks can often form 2 to 3 quality bases in a bull move, before undergoing large corrections. After 3 bases many basing patterns will be faulty and failure prone. So right now, many stocks may still be in quality basing periods. Having a chart defined stop or a sound % loss limit will help to assure not sticking around in failed bases or subsequent major market turns to the downside.

Now the chart above is LFT which is a top 20 IBD stock right now. This chart was made Friday and does not reflect today's action. The notes on the chart show key points and how I would trade it. I am not in this but may trade it soon. Price moved above the buy point on that chart today, and volume is running high, but it looks more like the handle is continuing to form rather than a real breakout. So it may be more sensible to move the buy point to a few cents above today's high, to help avoid a failed breakout. Earnings is Aug 18 I believe FYI.

This is a chart of JST, another IBD 100 stock. Last week I bought this after it had broken out on heavy volume. I used a limit order of the breakout price (33.00)to catch it on a retest back to that price level. So these two charts show how I would buy growth stocks breaking out of bases. If you see the base before the breakout, you use a buy stop order to buy on a move up above the breakout price (handle, midpoint, old high, etc). If you don't see it before the breakout, or you are unsure about the base, then you can wait till the breakout, and use a buy limit order corresponding to the breakout price to get it IF it comes back down to the breakout price.

The problem with the second way is that you may not get filled because price doesn't come back down that far. However, it may save you from some failed breakouts. Look at the notes for when to get out. In general, you simplify the exit by selling with a market or limit order when the price is up 3 times the amount of your risk (in percent terms). The key to keeping a good risk reward ratio is to exit the stock on any close back below the breakout point - that will get you out several percent better than getting stopped out most of the time, possibly cutting the size of your average loser in half if compared to always getting stopped out.

Another notable stock that is breaking out today is TNDM. I had considered highlighting this recently, but the base is choppy looking, so I didn't really want to use it as an example. However, now that heavy volume is coming in on a breakout, you could use the buy limit method to buy it on a pullback to the breakout point of 31.50. Then follow all the rules about getting out if price closes below that level.

I don't really intend on posting trades on individual stocks like this on the blog (at least not until I believe that we are in a legit long term bull), but I know some of you reading this are familiar with and interested in this methodology, so please do your own homework on any stocks I bring to the table, and feel free to post comments or questions.