Click on Chart to Enlarge

The daily MACD has turned down on the indexes now as shown in the chart above. However, so far this move down is much slower than the move up off the late Nov low. So I think the odds favor the market turning up here, similar to mid April. The seasonality is positive and there is no confirmation of a new downward pattern yet, so the odds are that the market drifts up over the near term.

Click on Chart to Enlarge

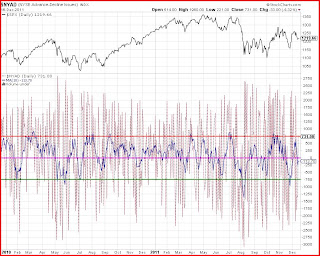

The 10 day advance-decline average did not hit quite the extreme level on this last little rally, for a top of a leg up. The average crossed back below zero which is usually a decent continuation sign for a downward move after an extreme reading, but it may be a whipsaw here.

The equity put/call ratio was above 0.90 the last 2 days, which is a little odd given the mainly positive bias Friday. From a contrarian standpoint, it would favor at least a day or 2 bounce from these levels. Longer term I don't think it is very significant.

Again the 1226 SPX level is a significant harmonic level. If the market stays under that level (which it did close back under after moving above it Friday) it would favor continued weakness on that front.

Probably the most reasonable expectation is for a somewhat lackluster and slightly positive market into the New Year time frame. Then likely some selling afterwards would be my guess.

[As a side note, I will be making some significant changes to the blog for 2012. I will make a more detailed post going over those as I make them.]

No comments:

Post a Comment