Currently many measures of market sentiment are in excessive optimism territory.

One of the data sets I follow closely and which is a real money measure of sentiment is the equity put/call ratio from CBOE.

Currently there is a relatively low reading on the 21 day average, the lowest going back to mid 2014.

However I looked at this from a larger scale relative basis and what I did was to take the 21 day average a divide it by the 84 day average. So we are taking the last 1 month readings relative to the last 4 months total.

Currently the ratio stands at 0.92 which is a relatively low reading for the data set.

I then searched for past times when these low readings occurred at a 52 week high and with a close of SPY above its upper bollinger band.

I removed clustering of a few readings where a few days occurred in a short period (like is occurring now).

And the results were a notable bearish skew to forward returns for the next couple months, but being most notable at 1 week to 1 month ahead.

This was pretty consistent as well in that 9 out of 10 instances had equal or greater MAX losses over the next week relative to gains and the MAX losses on average were over 3.5 greater than the MAX gains.

In 7 out of 10 instances there was a 1 week forward looking MAX loss greater than 1%.

Looking out 1 month, when removing clustering and leaving only the very first reading of a cluster, there was ~2.5 greater MAX loss than MAX gain over the coming month. 6 out of 9 instances had MAX losses of 2% or more in the next month. 6 out of 9 instances also closed negative at the 1 month forward mark.

Given my overall assessment of the market here, I would estimate that the above numbers give a fair risk assessment for the upcoming weeks. I would not be surprised to see a 3% or more decline over the next 3-4 weeks, from this week's opening values.

Pete

Showing posts with label equity put/call. Show all posts

Showing posts with label equity put/call. Show all posts

Tuesday, January 9, 2018

Monday, July 14, 2014

VIX:VXV Ratio Pointing to a Near Term Market High?

Click on Chart to Enlarge

This chart of the VIX:VXV ratio goes back 3 years, and represent 1 month implied volatility over 3 month implied volatility. If you have no back ground in this ratio, then search this blog for the VIX/VXV label to get past interpretive info.

What I want to point out here is that when the ratio spikes to a LOW level - meaning below the lower bollinger band - that event has consistently NOT been right a market high. I discussed this briefly several weeks ago at the end of May. Looking back over the lats 3 years of chart history, we see that the low in VIX:VXV occurred 6, 4, 8, and 6 weeks before the most significant market corrections, though in March 2012 it was only about 2 weeks until the high, but 6 weeks until a small double top before the correction really occurred.

So averaging those out we see that it has been about 6 weeks after the low VIX:VXV that prices made a high and corrected for several weeks. Interestingly, we are currently right at 6 weeks from the most recent low in the VIX:VXV. So based upon this very simple analysis, it gives us a heads up from volatility analysis of real money data in the options market, that we may be in the time frame for the market to peak and correct here. Additionally, as of today we have a very sharp bearish divergence on the daily time frame in QQQ and other than the Dow managing to poke up to a slight new high, the other indexes like Russell 2000, S&P 500, Nasdaq Composite, Wilshire 5000 are not making new highs, so we have some non-confirmations and technical bearish divergences present.

Also recently we saw a extremely low equity put/call ratio average. Similar comments apply there as to the VIX/VXV. The low point in the equity put/call ratio has been a couple weeks to a couple months prior to the price peaks before the major corrections. Currently we have a June 19th low in the 10 day average of the equity put/call and are nearly 4 weeks removed and price pushing to higher highs.

Taken together, my opinion is that the market is set-up virtually identically to the sentiment backdrop that has occurred right at the highs before recent market corrections. So, only time and market action will tell whether the recently consistent tendencies will follow here, my vote is that there is unlikely to be any appreciable price rise from this level over the next several weeks, and we could very well experience another broad based correction in stocks.

This chart of the VIX:VXV ratio goes back 3 years, and represent 1 month implied volatility over 3 month implied volatility. If you have no back ground in this ratio, then search this blog for the VIX/VXV label to get past interpretive info.

What I want to point out here is that when the ratio spikes to a LOW level - meaning below the lower bollinger band - that event has consistently NOT been right a market high. I discussed this briefly several weeks ago at the end of May. Looking back over the lats 3 years of chart history, we see that the low in VIX:VXV occurred 6, 4, 8, and 6 weeks before the most significant market corrections, though in March 2012 it was only about 2 weeks until the high, but 6 weeks until a small double top before the correction really occurred.

So averaging those out we see that it has been about 6 weeks after the low VIX:VXV that prices made a high and corrected for several weeks. Interestingly, we are currently right at 6 weeks from the most recent low in the VIX:VXV. So based upon this very simple analysis, it gives us a heads up from volatility analysis of real money data in the options market, that we may be in the time frame for the market to peak and correct here. Additionally, as of today we have a very sharp bearish divergence on the daily time frame in QQQ and other than the Dow managing to poke up to a slight new high, the other indexes like Russell 2000, S&P 500, Nasdaq Composite, Wilshire 5000 are not making new highs, so we have some non-confirmations and technical bearish divergences present.

Also recently we saw a extremely low equity put/call ratio average. Similar comments apply there as to the VIX/VXV. The low point in the equity put/call ratio has been a couple weeks to a couple months prior to the price peaks before the major corrections. Currently we have a June 19th low in the 10 day average of the equity put/call and are nearly 4 weeks removed and price pushing to higher highs.

Taken together, my opinion is that the market is set-up virtually identically to the sentiment backdrop that has occurred right at the highs before recent market corrections. So, only time and market action will tell whether the recently consistent tendencies will follow here, my vote is that there is unlikely to be any appreciable price rise from this level over the next several weeks, and we could very well experience another broad based correction in stocks.

Sunday, June 1, 2014

Equity Put/Call Ratio Sell Warning

Click on Chart to Enlarge

This chart shows that the 5 day average of the equity put/call ratio is outside its 1 month, 1 standard deviation band. I frequently use this signal on a total put/call data chart as a timing indicator to identify when legs up in stocks are about to end.

Based on a typical signal like this I would take some of the following courses of action:

- Move stop losses under minor support on long positions so that you can stay with an uptrend but get taken out on any technical break

- Exit part of long positions at the current levels, and maintain another portion with a trailing stop or stop movement strategy

- Exit long call options on index calls or any near term equity call options

- Build and narrow down a list of potential short candidates based upon your trading time frame. Identify precisely what signals are needed to establish short positions, and exactly the appropriate amount of risk for your trading style and plan.

Again, as I suggested in my last post and on the notes on the chart above. I would expect that the market has some further upside in it, but seeing as the Nasdaq is at a breakout point, and the Russell 2000 is well below resistance, I am not convinced that we will see successful breakouts on all the indexes prior to the next 1+ month duration correction in the stock indexes.

So after a good call in my recent post suggesting that QQQ would likely rise until further notice, consider this further notice that the easy money may be already made on this move.

Sunday, June 3, 2012

Stock Market Update 6-3-12

Weekend Market Update 6-3-12

This video is a comprehensive look at multiple times frames of the US equity market. It appears probable that a 2-4 week rebound will occur, followed by what could be a tremendous declining phase. Larger scale patterns suggest this bear market will take stocks below the 2009 lows.

Sunday, December 18, 2011

Market Update

Click on Chart to Enlarge

The daily MACD has turned down on the indexes now as shown in the chart above. However, so far this move down is much slower than the move up off the late Nov low. So I think the odds favor the market turning up here, similar to mid April. The seasonality is positive and there is no confirmation of a new downward pattern yet, so the odds are that the market drifts up over the near term.

Click on Chart to Enlarge

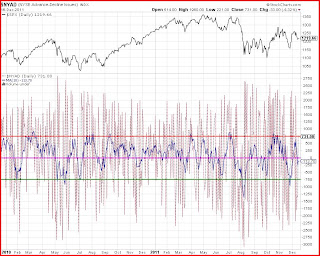

The 10 day advance-decline average did not hit quite the extreme level on this last little rally, for a top of a leg up. The average crossed back below zero which is usually a decent continuation sign for a downward move after an extreme reading, but it may be a whipsaw here.

The equity put/call ratio was above 0.90 the last 2 days, which is a little odd given the mainly positive bias Friday. From a contrarian standpoint, it would favor at least a day or 2 bounce from these levels. Longer term I don't think it is very significant.

Again the 1226 SPX level is a significant harmonic level. If the market stays under that level (which it did close back under after moving above it Friday) it would favor continued weakness on that front.

Probably the most reasonable expectation is for a somewhat lackluster and slightly positive market into the New Year time frame. Then likely some selling afterwards would be my guess.

[As a side note, I will be making some significant changes to the blog for 2012. I will make a more detailed post going over those as I make them.]

Labels:

CPCE,

equity put/call,

nyad,

SPX

Saturday, November 28, 2009

Some Charts to Help Gauge Sentiment

This chart I often show which is the equity put/call ratio with 21 and 34 day averages. It is used as a contrarian indicator. When the ratio reaches extreme highs or lows, that can be helpful in timing market turns. But looking at the intermediate averages helps to see the longer ebb and flow of fear in the options market. Despite the senior indexes being only marginally off highs, the averages have started to trend up for the last month indicating a shift in sentiment that often accompanies a market downtrend.

This chart is from Sentimentrader.com and is a very interesting look at some of the Rydex fund data that they track. This particular study looks for times when the level of buying or selling in Rydex funds is disproportional to the price movement in the market. When there is lots of buying/inflow while the market does not really makes substantial gains (or even declines) that shows that the Rydex traders are buying the dips or are overly enthusiastic about further gains. During the rally since March when several readings like that show up in a cluster or narrow price range, it has often been at short term tops. We are seeing this again over the last 2 weeks.

This chart is from Sentimentrader.com and is a very interesting look at some of the Rydex fund data that they track. This particular study looks for times when the level of buying or selling in Rydex funds is disproportional to the price movement in the market. When there is lots of buying/inflow while the market does not really makes substantial gains (or even declines) that shows that the Rydex traders are buying the dips or are overly enthusiastic about further gains. During the rally since March when several readings like that show up in a cluster or narrow price range, it has often been at short term tops. We are seeing this again over the last 2 weeks. This chart is also from Sentimentrader.com. It is what they call the Options Speculation Index and is a broad measure of bullish and bearish bets in the option market. It is used as a contrary indicator and excessive call activity often happens near market highs (and vice versa). This ratio looks at the ratio of calls bought to open and puts sold to open divided by puts bought to open and calls sold to open. The ratio jumped to multi year highs last week, which indicates that the options market is leveraged excessively toward the call side.

This chart is also from Sentimentrader.com. It is what they call the Options Speculation Index and is a broad measure of bullish and bearish bets in the option market. It is used as a contrary indicator and excessive call activity often happens near market highs (and vice versa). This ratio looks at the ratio of calls bought to open and puts sold to open divided by puts bought to open and calls sold to open. The ratio jumped to multi year highs last week, which indicates that the options market is leveraged excessively toward the call side.  This chart is the OEX put/call ratio for 2009 so far. Unlike most put/call ratios I mention this one is a smart money indicator typically as smart traders buy puts as hedges when the market has gotten ahead of itself. In the past there have tended to be several spikes up in this ratio as a significant top approaches. The ratio spiked up on Friday again to 2.04. The intermediate averages of this ratio are also showing this group to be maintaining consistently high put exposure (on a relative basis) consistent with expectations of significant downside risk in the markets.

This chart is the OEX put/call ratio for 2009 so far. Unlike most put/call ratios I mention this one is a smart money indicator typically as smart traders buy puts as hedges when the market has gotten ahead of itself. In the past there have tended to be several spikes up in this ratio as a significant top approaches. The ratio spiked up on Friday again to 2.04. The intermediate averages of this ratio are also showing this group to be maintaining consistently high put exposure (on a relative basis) consistent with expectations of significant downside risk in the markets.Another thing of note on the sentiment front is that one of the lowest bearish % readings in the Investors Intelligence survey occurred this week. This is a contrary indicator typically but is best used to time the market with the larger trend. So the question is whether we are still in a longer term bear market in which case I would find this very significant. The 200 day moving average (which is a simple way to gauge long term trend) is pointed up now though. But with several other signs of longer term excess bullish equity speculation, I think it is notable. Also the survey showed a relatively high percentage of advisers expecting a correction. Despite the contrary use of this survey, this particular aspect of the survey has in the past functioned more as a confirming indicator and there often is some pullback when there is a high percentage expecting a correction.

Most of the above measures are more significant over the time frame of a few months rather than a few days. On a short-term time frame there is some mixed data. The VIX spiked up Friday and may be slightly bullish short-term. Also there was a very low cumulative TICK reading on the Nasdaq Friday, which should be bullish as well. But most other short-term sentiment gauges are neutral.

From a charting perspective, the close below 1100 on the S&P made a third failed breakout attempt above the Oct highs. This tends to be a good reversal price pattern. But any move above the recent highs is likely to succeed in a breakout. I maintain the view that the market is in a topping process which may be complete with this most recent failed breakout on the S&P. Tops tend to be slow in the forming and take persistence to establish a successful low risk-high reward position anticipating a new downtrend.

Subscribe to:

Posts (Atom)