Click on Chart to Enlarge

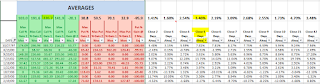

This is a SPY daily chart showing the action for the last 1 year or so. The red lines were the clear horizontal support levels that were established in the uptrend. In past market tops, when support is broken, there is often a rally to move above the price levels of the bottom support level. And that general area is the region where the best shorting opportunities have occurred.

And currently that is where SPY is situated. From the shorter term charts (15 and 30 min) it would seem ideal for another push to a higher high for the rally today or tomorrow.

But basically the rally has run its expected course in both price and time. I am now looking to speculate on the downside and have some put option orders which would likely fill on a push to yet higher highs above last week's high.

If the rally does stall here quickly, past similar scenarios would suggest a sharp deeper than 50% retracement of the rally which occurred from low to high. That may be just the first attempt at a retest of the lows, and it may not last.

But tomorrow seems like the ideal topping time to me. So my suggestion is to be totally prepped for the exact signals you look for to enter a short trade. Also, I would advise a scaled exit on this trade.

For instance, once the trade is entered and stop placed, set a limit order to exit half the position at a profit of 0.5 units. Then, if that is hit, move the stop down to half of its original amount.

Another similar option, is to set a half position exit at 1.0 unit (compared to stop loss amount), and then just maintain the stop until an exit signal is generated.

Pete