Today SPY sold off hard similar to what occurred last Thursday. The VIX rose 32% on the day, similar to the huge rise last Thursday.

Based on the back tests I've run, this is not really bullish over the intermediate term. The closing returns on SPY at 1 month after the signal has been barely positive, which is worse than normal.

But over the short term, particularly for about 1 week, the back tests are positive, with average positive closing returns on SPY being more than +1% at the 4 and 5 day marks after the signal. Then the gains start to fade to near 0 at 1 month after the signal.

However, the SKEW to MAX gains versus MAX losses over the next 5 days is a paltry 1.09, meaning that the average maximum gains are barely bigger than maximum losses over the next week. Basically what this means is that there were some big downers in the group, rather than a consistent tendency to trade in the positive without much downside. That small skew and real possibility of some big downside is not what I want to see for taking an equity trade. So I would avoid a simplistic long trade here on the equity ETFs.

That being said the tendency to rebound to some degree is so consistent, that the options have provided an outstanding profile for profit over the week following these signals. Every instance flagged in the backtest of about 22 instances has shown MAX gains of 0.96% or more in SPY over the next 5 trading days. And that has translated to some consistent gains in the weekly expiration call options.

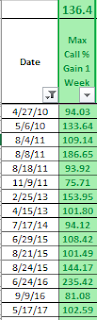

The following table shows stats based upon my model for the forward change in the option price for an at the money call option with 5 days until expiration. And the results here are ~90% of the past instances made MAX gains of 80% or more on the call option during the next 5 trading days. The way I construct the model is actually conservative (it is not based on actual contract data), and so in reality the results are probably even mildly better than this.

So the strategy here would be to purchase an at the money SPY call option with an August 25th expiration and then set a limit order to exit at 80% gain in price.

Now digging deeper into the past instances near term behavior, about 3/4 of the past instances showed at least some intra day loss on the day following the signal, and the average intraday drawdown was pretty high at ~1.5%. So this would argue that the odds favor setting a limit order to enter the trade that is equal to today's closing price for the option or lower. For those with skill in short term analysis and ability to watch the markets, could watch a short term intraday chart tomorrow to see if short term bullish divergence develops on the technical analysis, at which point an entry could be made at the market.

The following table shows some of the MAX gains in the call options and some of the dates for you to reference the charts. There are previous instances that dont fit on this screenshot.

The past instances show that if the day following the signal gaps DOWN, then there is a strong tendency for a short rebound to follow and for the day to close higher than the open by a wide margin.

Also if the next day gapped UP, then the future returns in the ETF itself are more negative.

So to translate this into an action plan, if SPY gaps up tomorrow, I WON'T buy the option at the open. But if it then trades lower during the day and creates some short term bullish divergence, then I will buy and set the limit gain order for 80%.

If SPY gaps down, I will buy the Aug 25th expiration at the money SPY call option at the open and set a 100% limit gain to exit.

No comments:

Post a Comment