Click on Chart to Enlarge

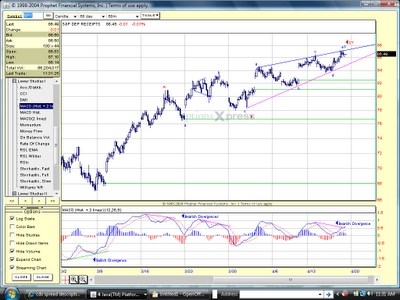

Tonight's chart is pretty loaded with notes because I wanted to make it as educational as possible for those interested in technical analysis.

It is best to just look through the chart and read the notes, but I wanted to talk about a couple indicators because they are less common and I rarely show them. Indicators like stochastics and RSI, and to a lesser extent MACD are oscillators and are most effective in markets trading in a range, not trending markets. Also bollinger bands are typically most effective as a trading instrument when the market is range bound as well. Less commonly looked at are trend identifying indicators.

The simplest trend based study is the moving average and that is probably the simplest way to gauge the current market. However, there are some more exotic studies that aim to identify trending markets. The two studies above and below the price chart are trend indicators. The top one is the Directional Movement Index (DMI). A trend is said to be present when the black ADX line is above 20 and rising. Somewhat surprisingly this indicator has not indicated a trending enviroment at this point though that could change pretty soon I think. The bottom indicator is the Aroon Indicator which also aims to identify trending conditions. This indicator is showing a trend with decent strength currently. So we have some mixed signals from these two indicators it seems.

The most interesting part of the chart (for me) is the candlestick pattern in relation to the bollinger bands and the January and February highs. Thursday's session formed a classic doji candlestick in the NYSE cash index. The upper shadow was long and pierced the upper bollinger band, but reversed to close below the band. Volume increased from yesterday which shows an intense struggle at the current level. This candle pattern is more reliable as a signifcant reversal if there is confirmation the following day (a down day tomorrow).

As I said a couple weeks ago, I keep focusing on the bearish evidence because the real money gauges of sentiment are on par with major market turns in the past. Price has chopped around more since those extremes have registered, but prices have held up pretty well. When price "ignores" these types of extremes I think it means those betting against the trend need to be careful. Late last September the market was in a place where it "should" have been able to rebound, but it didn't for more than a couple days at a time and continued on into a panic phase. While the emotions at tops and bottoms are different, it may be possible for an analgous upside blow off if prices are able to overcome this week's highs, so I think caution is warranted for bears with the potential catalyst of bank stress test results and so on. If the current levels are convincingly exceeded, there is no obvious chart based resistance until the mid 900's on the S&P 500.

I will post tomorrow in regards to exiting (or holding....maybe) the current BGZ trade.

It is best to just look through the chart and read the notes, but I wanted to talk about a couple indicators because they are less common and I rarely show them. Indicators like stochastics and RSI, and to a lesser extent MACD are oscillators and are most effective in markets trading in a range, not trending markets. Also bollinger bands are typically most effective as a trading instrument when the market is range bound as well. Less commonly looked at are trend identifying indicators.

The simplest trend based study is the moving average and that is probably the simplest way to gauge the current market. However, there are some more exotic studies that aim to identify trending markets. The two studies above and below the price chart are trend indicators. The top one is the Directional Movement Index (DMI). A trend is said to be present when the black ADX line is above 20 and rising. Somewhat surprisingly this indicator has not indicated a trending enviroment at this point though that could change pretty soon I think. The bottom indicator is the Aroon Indicator which also aims to identify trending conditions. This indicator is showing a trend with decent strength currently. So we have some mixed signals from these two indicators it seems.

The most interesting part of the chart (for me) is the candlestick pattern in relation to the bollinger bands and the January and February highs. Thursday's session formed a classic doji candlestick in the NYSE cash index. The upper shadow was long and pierced the upper bollinger band, but reversed to close below the band. Volume increased from yesterday which shows an intense struggle at the current level. This candle pattern is more reliable as a signifcant reversal if there is confirmation the following day (a down day tomorrow).

As I said a couple weeks ago, I keep focusing on the bearish evidence because the real money gauges of sentiment are on par with major market turns in the past. Price has chopped around more since those extremes have registered, but prices have held up pretty well. When price "ignores" these types of extremes I think it means those betting against the trend need to be careful. Late last September the market was in a place where it "should" have been able to rebound, but it didn't for more than a couple days at a time and continued on into a panic phase. While the emotions at tops and bottoms are different, it may be possible for an analgous upside blow off if prices are able to overcome this week's highs, so I think caution is warranted for bears with the potential catalyst of bank stress test results and so on. If the current levels are convincingly exceeded, there is no obvious chart based resistance until the mid 900's on the S&P 500.

I will post tomorrow in regards to exiting (or holding....maybe) the current BGZ trade.