Click on Chart to Enlarge

First let me immediately state that this study is NOT currently active. It is a "what if" scenario. What if SPY ends up breaking this Thursday's low with a weak close in the bottom half of the range?

That would be a reversal failure type scenario because yesterday price broke to a 3 month low, and reversed to close above it. So basically I am posing the question of what happens if a reversal attempt from a low (with bullish divergence in sentiment) fails to form a low which holds.

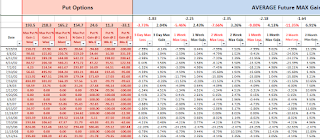

What the table demonstrates is that a break to new lows would suggest a bearish skew looking forward based upon historical comparisons from the last 21 years of SPY history.

The skew is pretty strong out to 2 months later, with greater MAX declines on average than MAX gains. Looking at the 2 week forward time frame, there have been some significant declines following these breaks. If trading the options, the maximum expected value play for my system involving at the money options, would be to buy an ATM put with 2 weeks until expiration, and set a limit order gain of 200% to exit the trade. The win rate on the past instances was only 44% and the Kelly Bet was low at about 15%. So it would justify only a smaller position but the expected value was strong at ~32%.

What about the equity side of things? Well first off there is a difference between just shorting on a stop order to new lows versus letting the break to new lows happen and then waiting to see if prices are able to again reverse higher. The backtesting suggests a stronger downside skew if prices break to new lows AND close in the lower half of the range. So that is the scenario the above stats are for, and what the strategy would be here on the ETF side.

Based upon my system and backtests, if we entered short SPY at the close of a failure day as discussed in the above paragraph, and set a stop order 7.75% above prices in SPY, and a limit gain order 7.75% below prices, but exited at the close 9 trading days later if the orders weren't hit, it would produce a nice 2.36% expected value. That is using SPY unleveraged. The back test stats justify 3x leverage on the short side in this case though. And the win rate was 64% on the past 25 instances.

So we could expect about a 7% gain on average using the 3x short ETF like SPXU or SPXS.

That is a very nice set-up for profiting quickly in a down market.

So if there are questions on this let me know. But if you use alerts, you could set an alert on SPY if price moves to 211.20 or lower to make sure you understand that price is breaking to new lows and this set-up will be in play if the day's close is weak (below the mid point of the day's range).

Pete

FYI

ReplyDeletethis screenshot probably does not include all instances. There may be some that did not fit. Comment if any further info is needed to look at dates.