Here is a relatively simple scan:

- VIX/VXV less than 0.86

- VIX up more than 2%

- SPY up more than 0.1%

Now the VXV has a limited history going back about 8 years. So we only have instances from the current bull market to judge. However, I ran the same basic idea and removed the VIX/VXV filter and instead ran added a filter of the 5/63 day total put/call ratio being less than 0.92. And the same approximate results occurred even with different days showing up.

Click on the Chart to Enlarge

This chart shows the summary of future returns for the next 6 months. We can see there are not many instances, but basically stocks had run out of steam and were set for a significant pull back over the coming weeks, beginning soon. The skew is very negative over the coming couple months.

As for the options there are profitable plays in several different strikes and time frames I am sure.

But I think the most sensible is the following purchase of an option.

Click on Chart to Enlarge

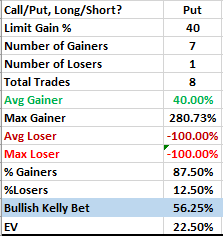

This chart summarizes the past results of buying an at the money put option with 2 weeks until expiration and setting a limit order to exit at a gain of 40% or letting the option expire worthless.

7 out of the past 8 instances hit the limit order making for a very nice opportunity.

In the current circumstance the closing value of SPY was more negative at 8 days forward compared to 10 days forward, so it indicates that the maximum gain was likely to occur within 8 days from entry of the option. So the option to purchase would be the standard June 17th expiration option. In this case I would go with the 212 strike put on SPY.

The key to long term success once a profitable method is obtained is to have as close to optimal money management as possible and to always stay "in the game". So my point here is that the above profile suggests an aggressive position is very justifiable. But if you use a simple % of account allocation on all trades, then there are many profitable orders. Buying 2 months until expiration and setting a 70% or 130% limit gain and letting losers expire worthless will also both provide profitable plays based on past stats, and allow for this month's expiration to pass if there is anything holding the market up through expiration.

So it may make sense to take the full position and split it into 2 parts, with half in the 2 week until expiration and half with a 2 month expiration 212 SPY put.

On the equity side, entering short SPY here and then setting a paired limit order and stop loss order of 6.75% or exiting after 2 months was a simple a nicely profitable trade. The expected value on SPY was about 3.5%. Stats allowed leverage of 3x on the whole account if using a triple leveraged bear ETF. So the return expected on the account would be about 10% expected over the next 2 months by using the 3x inverse ETF. This would be a more conservative play, but one that could be used in all types of accounts and provide a standout return during an expected downtime in the markets.

I know this post has a lot to sort through, so comment or reply if you have questions regarding the info or your situation.

Pete

No comments:

Post a Comment