Move the GTC buy stop on SLV down to 31.47. This continues to develop nicely, and another big payoff is likely ahead yet. I think this will make a big nose dive in the next few weeks/months, and then I think the odds favor a choppy longer lasting bear market, but I have intention of holding through that type of environment. So my intention is really to stay in for the next big move down, and then cover the trade.

Move the GTC sell stop on GLL up to 15.94. Gold has made a nice move since our entry, but as with silver, I believe the bigger payoff is still in the weeks ahead.

Place a GTC sell stop on the open EUO trade at 18.68. This is a 2x inverse Euro ETF, so it will move up as the US Dollar gains, and the Euro falls (and commodities fall also).

Saturday, December 31, 2011

Thursday, December 29, 2011

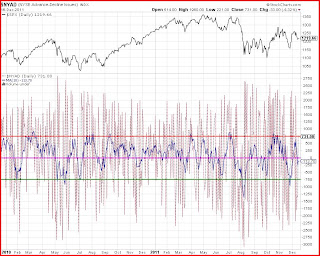

Waiting on a Breakout - Likely Down

Click on Chart to Enlarge

See the chart above for notes. The upside moves in stocks have been technically counter trend with respect to the ADX indicator. I think this suggests that the next breakout move will be down.

Click on Chart to Enlarge

Also a large triangle is forming after a downward move. Most triangles break out in the direction of the prior trend. I have no good reason to believe this one won't break out to the downside.

In either case, expect a MAJOR market move starting within the next week or two. If you are positioned against the trend, it will likely go very badly.

DJIA Chart

Click on Chart to Enlarge

The Dow 30 made a small range doji on Tuesday which was confirmed yesterday with a down day with a close at the bottom of the range. This occurred in the context of a 4 month high and an attempted breakout above the Oct high which failed as of yesterday's close back below it. Also the upper bollinger band was just above price. That may cap any breakout attempt here.

A lower low than Wednesday's will trigger a daily stochastics sell signal and the weekly stochastics are overbought. So this is a great short trade set-up here for discretionary traders. Also the price is just under the 78.6% retracement of the May-Oct decline. That is often the furthest a rally will go when maintaining the larger trend.

Gold and silver have both back-tested their bull market trendlines from the underside and now have broken to new lows as of yesterday. Gold gapped down today, and while on the surface it looks oversold, this has the potential to go into a near vertical decline in this position. I will move stops again on GLL and SLV soon.

Wednesday, December 28, 2011

TBT Stopped Out

The TBT trade open since October was stopped out at 17.60 on the 19th of Dec. Based on moving averages the bonds are in an uptrend. While some indications are that this market is overbought and should decline, if stocks falter from here, the typical response would be a flight to bonds. And I don't see anything concrete to suggest that won't happen again on any near term market scares.

Friday, December 23, 2011

Merry Christmas

Merry Christmas to everybody out there!

Expect very light volume today with no major moves. Looks like a modest gap up expected this morning, but I wouldn't guess there would be a large open to close move.

There are converging trendlines forming from the Oct-Dec high and Oct-Nov lows, indicating a possible large horizontal triangle formation taking place off the Oct low. Often times the upper trendline will be briefly exceeded before the "e" wave ends. I think we may see that here over the next few days, and then I expect renewed selling as we come out of the Holiday season.

The large, "smart-money" commercial traders have sold heavily at two distinct zones over the last year. The 1260 SPX level (which is basically the neckline of the head and shoulders top formation) and the 1320-1330 SPX level have been the areas where they have sold and would be expected to sell heavily and drive prices down again. Obviously we are in that 1260 area now, so it is possible that we are very close to seeing this rally attempt end.

All the best,

Pete

Expect very light volume today with no major moves. Looks like a modest gap up expected this morning, but I wouldn't guess there would be a large open to close move.

There are converging trendlines forming from the Oct-Dec high and Oct-Nov lows, indicating a possible large horizontal triangle formation taking place off the Oct low. Often times the upper trendline will be briefly exceeded before the "e" wave ends. I think we may see that here over the next few days, and then I expect renewed selling as we come out of the Holiday season.

The large, "smart-money" commercial traders have sold heavily at two distinct zones over the last year. The 1260 SPX level (which is basically the neckline of the head and shoulders top formation) and the 1320-1330 SPX level have been the areas where they have sold and would be expected to sell heavily and drive prices down again. Obviously we are in that 1260 area now, so it is possible that we are very close to seeing this rally attempt end.

All the best,

Pete

Sunday, December 18, 2011

US Dollar and Gold Update

Click on Chart to Enlarge

See chart above for notes on gold. All data confirms a major breakdown occurring in gold. We are likely to see sharply lower prices in coming weeks. I would anticipate at least to the green circle area by Jan options expiration.

Historically, bull markets such as the current gold and silver bull markets, are likely to retrace around 85% of the bull market on average within 2 years. This is taking it from the 2008 lows. So, that gives us some reference points that these are likely headed much lower. How long it takes, I think probably not 2 years in this case, but we will see.

Click on Chart to Enlarge

The US Dollar Index is confirming commodities should continue down. Watch for this to heat up quickly.

If there is a factor that keeps stocks from the typical positive seasonality over the next couple weeks, I believe it is the precarious position of gold and the corresponding breakout in the US Dollar Index. I would not dabble on the long side here.

Market Update

Click on Chart to Enlarge

The daily MACD has turned down on the indexes now as shown in the chart above. However, so far this move down is much slower than the move up off the late Nov low. So I think the odds favor the market turning up here, similar to mid April. The seasonality is positive and there is no confirmation of a new downward pattern yet, so the odds are that the market drifts up over the near term.

Click on Chart to Enlarge

The 10 day advance-decline average did not hit quite the extreme level on this last little rally, for a top of a leg up. The average crossed back below zero which is usually a decent continuation sign for a downward move after an extreme reading, but it may be a whipsaw here.

The equity put/call ratio was above 0.90 the last 2 days, which is a little odd given the mainly positive bias Friday. From a contrarian standpoint, it would favor at least a day or 2 bounce from these levels. Longer term I don't think it is very significant.

Again the 1226 SPX level is a significant harmonic level. If the market stays under that level (which it did close back under after moving above it Friday) it would favor continued weakness on that front.

Probably the most reasonable expectation is for a somewhat lackluster and slightly positive market into the New Year time frame. Then likely some selling afterwards would be my guess.

[As a side note, I will be making some significant changes to the blog for 2012. I will make a more detailed post going over those as I make them.]

Labels:

CPCE,

equity put/call,

nyad,

SPX

Friday, December 16, 2011

SLV Trendline Break

Click on Chart to Enlarge

The SLV etf is shown above. It gapped from above its 2008-2011 bull market trendline to below the trendline with a large gap down on Wednesday. I noted a similar thing in gold on Monday. When trendlines are broken with large gaps, that is typically significant. Everything still indicates this is headed much lower. From my study of how these things go, I would expect the market to correct at least down to the beginning of the final "blow off" leg up of the bull market. That would be around 17.50 at the mid 2010 consolidation level.

With options expiration today and metals set to gap up up today, I don't expect downside today. We may see a move back up toward the trendline on SLV today for a backtest of the trendline. But I would expect continuation downward next week.

Thursday, December 15, 2011

In Case There Was Confusion...

A reader asked if the new 33.00 buy stop was correct for the short SLV trade, thinking I meant 23.00. I didn't know if anybody else had this confusion. I had previously recommended a GTC buy limit order to exit the position, but I am now recommending to just cancel that limit order and wait for things to unfold. What I did suggest is to move the protective stop loss on the short position down to 33.00 from the 36.50 area.

Here was my brief reply with a little more info..

"This is a short position in silver. So the buy to cover stop is above current prices. That is the stop loss to trail behind the trade. I am not going to post a limit order to exit the trade yet if that's what the confusion was. The prior limit was 26.00 but I am just suggesting to cancel that right now. I think it has a lot further to fall. Probably 17.50 will be the next limit order, but I'll just trail the stop for now and see how it develops for a while."

Here was my brief reply with a little more info..

"This is a short position in silver. So the buy to cover stop is above current prices. That is the stop loss to trail behind the trade. I am not going to post a limit order to exit the trade yet if that's what the confusion was. The prior limit was 26.00 but I am just suggesting to cancel that right now. I think it has a lot further to fall. Probably 17.50 will be the next limit order, but I'll just trail the stop for now and see how it develops for a while."

Stock Market Update

Click on Chart to Enlarge

See notes on the chart above. While it doesn't look like we will get the ideal confirmation of pattern completion here, I would again refer you to the pattern in silver this past summer which is similar to this pattern in stocks. It did not give classic confirmation right after the price high, but it drifted sideways to the B-D trendline, then gapped below it. Then it continued to chop for a few days before the bottom fell out.

Given the seasonal tendencies for stocks to rise during December expiration week, and for generally low volume and positive seasonality through the New Year, we may see something similar to that in stocks from here.

So bottom line, from all the historical comparisons and price logic applied to patterns, time seems to be drawing close to a major leg down in stocks. One point of note is that the 61.8% retracement of the 2007-2009 bear market is at SPX 1226. That is basically right where the market is now. I have noted that there is a recent node of harmonic confluence there and it's a level of repeated support and resistance over the past 5 years. I have looked at these situations on charts before and many times if prices close sharply below that level, it can lead to fast declines to the next major horizontal support level. So the market is kind of teetering on the edge here. From the way commodities are positioned and the recent breakout to new rally highs in the US Dollar Index, I expect the market to fall through the support.

Wednesday, December 14, 2011

SLV Short Update - Trade Modifications

Cancel the GTC buy to cover @ 26.00 order on SLV. Move the GTC buy stop down to 33.00 on SLV.

Brief Notes

The S&P 500 did complete the stochastics sell signal on the daily time frame on Monday. So the stop for a new short entry would be above last week's high. I am not going to post any new trade on the stock indexes until I see how things unfold. All the other active trades already are set to make gains if the stock indexes fall.

As a side note, now that we have sit through a multiweek bear market rally in silver, I plan on removing the limit order to cover SLV at 26.00. I have said that I believe that this is a larger bear market in these metal, and I just wanted to cover at the first support before this rally. However, the SLV etf missed the target by a small amount and it did not get filled. But now we are in a better position where we can move the stop down a bit further and wait for silver to fall more. Given the long term context with silver likely to break its bull market trendline soon, I think there are quite a bit more gains to come on that position.

Also, gold did continue down yesterday. The lower daily bollinger band has now turned down. And the upper band expanded a wee bit. So this has the makings right now of a new stable downtrend developing in gold. Also the DMI/ADX indicator has moved into a a downtrend configuration on gold. The ADX has risen above 20 and prices are falling with downward directional movement strengthening.

As a side note, now that we have sit through a multiweek bear market rally in silver, I plan on removing the limit order to cover SLV at 26.00. I have said that I believe that this is a larger bear market in these metal, and I just wanted to cover at the first support before this rally. However, the SLV etf missed the target by a small amount and it did not get filled. But now we are in a better position where we can move the stop down a bit further and wait for silver to fall more. Given the long term context with silver likely to break its bull market trendline soon, I think there are quite a bit more gains to come on that position.

Also, gold did continue down yesterday. The lower daily bollinger band has now turned down. And the upper band expanded a wee bit. So this has the makings right now of a new stable downtrend developing in gold. Also the DMI/ADX indicator has moved into a a downtrend configuration on gold. The ADX has risen above 20 and prices are falling with downward directional movement strengthening.

Tuesday, December 13, 2011

Gold Update - Trendline Break

Click on Chart to Enlarge

The chart above is the GLD gold ETF. The red line is the trendline up since the 2008 low in gold. I had mentioned before that a break of that trendline would likely lead to sharp losses in gold. Yesterday gold gapped down from above the trendline to below the trendline. I always view that as significant. Based on everything I've shown in recent months I believe gold is most likely to continue its break down. There may be a backtest of the trendline here shortly after a break, but then any fall to new corrective lows, would be another sell point.

Silver is about 3% above its corresponding trendline and it really has space under it to fall.

I have us positioned in the blog trades to benefit from a general deflationary theme here in the coming weeks. Essentially we are short gold, oil, and stocks, and long the US dollar. The TBT trade is still open which makes us short bonds. If the other markets play out as expected I think the bond market may push up to new highs at this point, but unless it gets stopped out, I'll continue to hold.

Friday, December 9, 2011

DTO Trade Entry

The new DTO trade was entered at 42.20 on the open this morning. Used the GTC sell stop as receommended in the prior post.

Thursday, December 8, 2011

New Trade - DTO (2x Short Oil ETF)

Click on Chart to Enlarge

What I am going to do here is to post an inverse trade on oil because it is giving a really nice signal here, and everything is clear that it should lead to a nice decline. The dark lines on the chart above are projections of the typical declining legs in oil down from the recent high.

While I won't get into the chart here, on this rally open interest in oil has been falling as the price has been rising, and that is a short-covering pattern which implies that the larger trend is NOT up. Also, the commercial (smart money) traders have been selling on this rally as price has been rising. So that also suggests this is a sucker's rally.

Today's price break and MACD formation look to me like a "hook" on the MACD that should lead to continued selling with no new rally high. Since this pattern is very clear, and the possible reward on the 2x short ETF is around 100%, then I will post this trade, and give stocks some more time to develop and possibly post a trade if/when a more clear downtrend emerges. For those interested I would still suggest taking bearish technical trade signals on the stock indexes any day now.

New Trade:

Buy DTO with a market order at tomorrow's open. Place a GTC sell stop at 37.67 immediately after entry, and use that stop for position sizing also.

Market at Channel Resistance - Possible Sell Tomorrow

Click on Chart to Enlarge

A lower low in the S&P 500 tomorrow will trigger a trailing 1 bar low sell signal in the 14,3,3 stochastics. Previous signals are shown at the red vertical lines. Recent sell signals have been good times to get out of longs on a trading basis.

The blue lines denote the channel lines of the "flat" pattern that formed from April to July. The market has repeatedly used those channel lines as support and resistance thus. The market has again begun to reverse off the upper channel line. Also the last few days the S&P has been up against the 200 day SMA and has reversed down off it again today.

I view 1295 as the major horizontal resistance, so if the blue channel line is broken, that 1295 will be the next resistance.

It is not surprising to see stocks sell off a bit heading into the weekend. If the market truly is hinging upon anything that happens out of this ECB conference this weekend, then it may be expected to see some selling prior to "the news." Then it would not be uncommon for seemingly "good" news to come out from the meeting with a "Yea! We fixed it!" kind of headline, but the markets sell off on the "good" news.

If a lower low is made tomorrow in the S&P 500, which I think is quite likely, then I will post an inverse ETF trade on one of the indexes with a stop above the October highs. Time is running thin on all bearish scenario projections from my perspective. So it makes sense to take any sell signal here, and be willing to do it again over the next few weeks if the market does rise modestly further and stops the trade out.

Tuesday, December 6, 2011

S&P 500 Pattern Update

Click on Chart to Enlarge

Based on the pattern development I have posted here over the last year or so, here is my updated analysis. The first vertical blue line at the left is where I suggested a pattern completion this past summer. And it was confirmed at all levels expected by the following explosive price move down. So it is very clear to me that an upward market phase completed there. Since then we have spent 4 months retracing only about 75% of that decline which took about 2 weeks.

I see two possible ways to logically label the price formations since the August 9th low. Based on time relationships and cycles I have labeled it in the form above as a developing corrective pattern where the "e" wave is expected to approximate the "a" wave in price and time or relate by a 0.618 ratio. The pattern would be very similar (but with a larger "b" wave) to the pattern in silver which topped out this summer before the major swoon in September. Check out that pattern here. Also the great discrepancy between the initial sharp move down and the overlapping correction to follow is similar to what happened in silver. The pattern would also be similar to what happened in gold in 2008 as I have labeled in the chart below. If you look at the declines to follow these patterns you see they are very sharp. So buying January OTM put options may be a high reward trade opportunity for a move projected to break past the Oct lows in the S&P 500.

Click on Chart to Enlarge

The other way I see this pattern possibly being labeled is as an ABC down into the October low, and a still developing upward pattern with a complete A and B and working on C. However, the time relations are so similar in all the waves since August, that the way I have studied these patterns, I would not label it as such.

The conventional Elliott wave labelers I'm sure would say we currently are in wave C up off the Oct low, and they would probably expect a terminal impulse for wave C. Then the next move down would be extremely large and possibly bigger than anything we even saw in 2008.

Back to the first chart above, I have placed a tight red circle showing the resistance area on the S&P 500. The light green line is the average of all the bear market rallies since 2000 that I have shown before. That projects to right around this weekend. Also, the vertical blue lines from the pattern ending in July would show a nice time symmetry if the upward move were to complete right there.

All this is in the context of a possible "buy the rumor, sell the news" type of scenario with the European Union meeting this weekend. Not too dissimilar to what happened heading into the debt ceiling issues this summer in our government.

IF such a pattern as I have projected is completing soon, then we will have to see a major move down to confirm it. The move should at a minimum retrace the advance since the recent November low in less time than the rally took to form.

Saturday, December 3, 2011

Indicator Update

Click on Chart to Enlarge

The VIX has touched the lower bollinger band 3 days in a row. The last time this happened was right before the market plunged in the summer. However, with the bollinger bands relatively narrow, this set-up looks most similar to the Sept 2010 where the VIX began a new downtrend as stocks rose steadily. The VIX didn't CLOSE outside the lower band though, which is a better contrarian signal.

Click on Chart to Enlarge

This is a chart of daily TICK values. It is neutral after an extremely low reading at the end of last week. I really just use the moving average of the TICK values to gauge extremes then look for divergences at/after extremes. I take this as neutral currently.

Click on Chart to Enlarge

This is the advancing-declining issues chart with a 10 day average. Again look for it to reach extremes and diverge. Use the average crossing the "0" line as a confirmation of new intermediate term trend after a divergence. The average has not crossed the 0 line yet, but is close. I take this as neutral, but with upward momentum.

Click on Chart to Enlarge

Since May the equity put/call ratio has traded mostly between 0.55 and 0.85 with moves outside that range creating inflection points. The current reading is neutral. It may take a reading closer to 0.50 before any significant pullback.

At this point nothing looks to be stopping the index from moving to new rally highs off the Oct 4th low. It seems most likely that the market rises for the next 2-3 weeks before topping. Stock has tended to rise into options expiration week for the last few years. So that is still a positive as is seasonality into the new year. If the market makes it till Christmas without a major break, then I expect a top to form around that time.

Thursday, December 1, 2011

Gold Update

Click on Chart to Enlarge

This is an updated chart of gold which I had posted on Nov 15th. The green line is the typical 1st bear market rally after the first leg down off a high in gold. The projection is to Dec 7th, which is not a magical date just the average for a high of the 1st bear market rally. Given the current environment, it seems likely for gold to continue sideways to higher, possibly making a new rally high over the next week or so.

As a side note, there may be a significant reaction after next weekend when there is supposed to be a significant European Euro/debt meeting. It is possible that the gold market remains rather subdued until then. That meeting is Dec 9th, next Friday. So a possible major shift in gold prices may coincide with some policy decision or indecision in the news on that front.

The pink line in the chart above is the bull market trendline since 2008. If that trendline gets broken I think it will be a waterfall type decline with some dramatic losses in a relatively short time. The next chart support below would be the 1300-1400 range.

Wednesday, November 30, 2011

Click on Chart to Enlarge

The VIX touched its lower bollinger band today indicating that this reaction rally could possible stall out soon. Each time over most of the last year, when the VIX touched the lower band, the market soon topped out and corrected. The red lines show the last times when the VIX touched the lower band. Also the bands are not currently in a trending type configuration, so I don't presume that it will trend lower, though that could develop.

An interesting thing in the VIX today is the market made nice open to close gains and was up huge. However the VIX was down relatively modest compared to normal correlations. Also the VIX actually closed up from the open, which bucks the typical trend in the VIX which is inverse to the SPY/SPX. So I don't know exactly what this means, but it is a little odd for a typical market rally. I take it as a sign that the psychology is not in bull mode at this time at least. It looks a bit more like a bear market rally.

Click on Chart to Enlarge

A couple things to note here on SPY. First off the big gap down from last week has now been filled which could allow the market to top and continue lower in a downtrend. However, the gap was closed in a major way, and the market did not find any resistance there, so it may not be a factor for capping this reaction rally.

On another note, when a triangle forms at the end of a correction as I have labeled above, there will often be a reaction rally back toward the apex of the triangle after the initial breakout. We may be seeing that here. Tomorrow is the apex of that triangle.

Obviously these huge gains seem extremely bullish, and it may well be that. But most of these huge gaps up on news/etc that I can ever recall seeing are in bear market rallies. In any case, as I have posted previously, it would be more typical for the time frame of a normal bear market rally for the market to push to a new rally high before topping. So that wouldn't even really negate a possible bear market environment.

I don't have a great take on this right now as far as what to expect. But there are a few things I have mentioned here and looked at that would suggest if this is a bear market rally, it should be done in the next day or two.

Monday, November 28, 2011

What Today's Big Gap Up Means

Quantifiable Edges put a brief post today showing performance of SPY from open to close when it closed at a 20 day low yesterday and then gapped up 2% or more the next day. Since 2003 there have only been 6 instances. Most of them occurred in the context of the 2007-2009 bear market. All but one led to lower lows not long afterward. The one that didn't was on March 10th 2009 coming off the 2009 bear market low, the day after the closing low on March 9th.

Here is the take home. The day of the gap up has consistently seen continued gains from open to close. So expect today to be generally up. The next day had a higher high in every case with almost all of them gapping up the next day as well. However, most of them closed down the day afterward (which would be tomorrow in our case). The two that didn't close down the following day were the March 10th one which obviously kicked off a bull market. Also, the Nov 21st 2008 instance continued up the next day and led to a 5-6 week bear market rally. The other 4 instances topped soon afterward 1 day, 1 day, 5 day, and 3 days later respectively.

In our current market, there is an unfilled large gap down from last week at 121.98 on SPY. That is still a couple percent above current prices. So here is what may be the most likely scenario......A continued move up today, and some further upside tomorrow to fill that gap down....then possibly a move to new corrective lows below last week's lows.

The Nov 21st 2008 instance rallied in typical seasonal fashion until the new year, before continuing to decline. The seasonal tendency is so strong this time of year that maybe we should expect that this time around as well. However, the market seems to me to be in a significantly different context when looking at the technical analysis and also from a qualitative standpoint. In our case the weekly stochastics has just turned down from overbought. 5 out of the prior 6 instance occurred with the market coming off very oversold conditions as far as weekly stochastics. The incident after the flash crash was shortly after an overbought stochastics.

So, my expectation is for most likely continued downside below last week's low. However, possibly we may rally toward's year end.

Here is the take home. The day of the gap up has consistently seen continued gains from open to close. So expect today to be generally up. The next day had a higher high in every case with almost all of them gapping up the next day as well. However, most of them closed down the day afterward (which would be tomorrow in our case). The two that didn't close down the following day were the March 10th one which obviously kicked off a bull market. Also, the Nov 21st 2008 instance continued up the next day and led to a 5-6 week bear market rally. The other 4 instances topped soon afterward 1 day, 1 day, 5 day, and 3 days later respectively.

In our current market, there is an unfilled large gap down from last week at 121.98 on SPY. That is still a couple percent above current prices. So here is what may be the most likely scenario......A continued move up today, and some further upside tomorrow to fill that gap down....then possibly a move to new corrective lows below last week's lows.

The Nov 21st 2008 instance rallied in typical seasonal fashion until the new year, before continuing to decline. The seasonal tendency is so strong this time of year that maybe we should expect that this time around as well. However, the market seems to me to be in a significantly different context when looking at the technical analysis and also from a qualitative standpoint. In our case the weekly stochastics has just turned down from overbought. 5 out of the prior 6 instance occurred with the market coming off very oversold conditions as far as weekly stochastics. The incident after the flash crash was shortly after an overbought stochastics.

So, my expectation is for most likely continued downside below last week's low. However, possibly we may rally toward's year end.

Saturday, November 26, 2011

Intermediate Term Top and Bull Market High Confirmed in SPX?

Click on Charts to Enlarge

The weekly stochastic indicator (14,3,3) made a bearish cross this week after a sharp rally in the index up to the 200 day SMA. This is very similar to what occurred in 2008 into the May 2008 high. Check out the two pink arrows on the chart. This is a technical analysis signal that confirms this rally is likely complete.

The lower of the two charts above shows with vertical lines where the SPX was in the past when the monthly 14,3,3 stochastics crossed from above 50 to below 50 (both the %K and %D). Both confirmed bull market tops were completed.

On a multiple time frame momentum perspective here is where we are:

-monthly neutral and trending down

-weekly overbought and just turning down

-daily oversold

So the market is probably due for a brief rally soon, but the larger momentum currents appear to be down.

Wednesday, November 23, 2011

SDS Exit

The SDS trade was exited at 22.55 on the open this morning.

There is still downside potential for stocks, but the large unfilled gap up at the 61.8% retracement of the Oct rally is just under prices, and the market could find support and bounce there. At this point I am not really looking to try to catch a bottom here, but if a nice looking bullish reversal occurs, I may consider a bullish trade if the market forms a higher swing low on the chart.

There is still downside potential for stocks, but the large unfilled gap up at the 61.8% retracement of the Oct rally is just under prices, and the market could find support and bounce there. At this point I am not really looking to try to catch a bottom here, but if a nice looking bullish reversal occurs, I may consider a bullish trade if the market forms a higher swing low on the chart.

Tuesday, November 22, 2011

Limit Order to Exit SDS

Place a "day only" limit order to sell the open SDS trade tomorrow at 22.14 or better.

As long as there is not an unfilled gap up tomorrow, it will be filled. If there is a big gap up, then the market should push to fill Monday's gap down. In that case I don't think the market will be able to continue up without a retest of these lows at least, because the upper bollinger band is still moving upward and the volatility breakout is not complete. If that gap is filled, then after that another break to new lows for the correction could get more severe. As long as both the upper and lower bollinger bands are expanding away from each other, the market often experiences rather violent moves in the direction of the trend. In this case, until the top band rolls over, there could be increasingly large downward moves. However, the expansion in QQQ is already at 4 days, and on average the expansion period doesn't last much longer than that.

Also, gold is in a precarious position hovering just above its bull market trendline and just above the lower bollinger band. It touched the lower band yesterday. I will try to get into more detail on this concept as time allows, but IF the market breaks to a new low after a brief reversal off the lower band, the bottom will often fall out of the market. It think that may happen here in gold, and possibly in stocks as well.

As long as there is not an unfilled gap up tomorrow, it will be filled. If there is a big gap up, then the market should push to fill Monday's gap down. In that case I don't think the market will be able to continue up without a retest of these lows at least, because the upper bollinger band is still moving upward and the volatility breakout is not complete. If that gap is filled, then after that another break to new lows for the correction could get more severe. As long as both the upper and lower bollinger bands are expanding away from each other, the market often experiences rather violent moves in the direction of the trend. In this case, until the top band rolls over, there could be increasingly large downward moves. However, the expansion in QQQ is already at 4 days, and on average the expansion period doesn't last much longer than that.

Also, gold is in a precarious position hovering just above its bull market trendline and just above the lower bollinger band. It touched the lower band yesterday. I will try to get into more detail on this concept as time allows, but IF the market breaks to a new low after a brief reversal off the lower band, the bottom will often fall out of the market. It think that may happen here in gold, and possibly in stocks as well.

Thursday, November 17, 2011

SPY Pattern Update

The chart above has an updated wave labeling on SPY. It looks most likely to me that this rally is now complete. However, if it is not then I expect a push to new highs over the next 2 weeks.

The reason I believe the rally may be complete is due to pattern and the bollinger bands. The data I recently showed would suggest that a new high is likely on the rally based on time averages. That has to be used as a guideline, but it's not set in stone.

Many chart analysts have noted the symmetrical triangle that formed in SPY over the last few weeks. Many expected it to break to the upside. I have noted in the past how complex corrections often END with contracting triangles, and that often throws people off on the direction of the breakout. That is what I believe is happening here. It looks to me like a w-x-y pattern ending with the "y" pattern as a contracting triangle. A triangle would not be expected to form in the "y" position if a "z" were to follow. The triangle is the typical ending pattern. By that logic, this suggests the current rally in stocks may be over.

I noted earlier today that the QQQ made a downside breakout of its bollinger bands. It did close beneath the lower band today, which is good confirmation of a new trend. I would expect the market to continue in the downward direction in this case.

On the other hand, the bollinger bands on SPY contracted slightly today, and the market touched the lower band, but it closed up slightly from the lows. So the jury is out on this one. A gap down and low close tomorrow, below the lower band, would be great further confirmation that the broad market is likely turning lower.

My take is to maintain the view that this is a bear market rally in stocks that is topping, and that commodities are going to continue down as well. Check out the USO etf. Oil put in a confirmed doji topping candlestick. Oil has been propping up the commodity indexes, so a top in oil will likely weigh heavily on commodity/energy stocks and the commodity indexes.

Possible Breakdown on QQQ

As I mentioned in the post last night, be looking for a breakout move on QQQ. While the day is still young today, if it closes where it is now it will be a great breakdown. The bollinger bands are expanding today which you want for a true volatility breakout. The market gapped in the direction of the breakout which is also good in this case. And a long bar from open to close (a long red bar in this case) is also good. If the market closes below the lower bollinger band today, then shorts can be entered with a stop one penny above today's high. Then don't exit until the bottom band inflects back up.

Now the hourly chart is oversold on the oscillators, so I would suggest waiting until just before the close to enter a trade to make sure not to get caught at a reversal at the lower band. Remember that average bear market rally would still have about 2 weeks to go before a high, so it is possible we touch down here, then start to rally for another week or so.

Wednesday, November 16, 2011

QQQ Waiting on a Breakout Move

See the chart above for some notes. I think that this market is set up for a major move, most likely down from these levels. You don't often see a 7 reading on the daily ADX. That indicates a period of extreme trendlessness. Those periods can be followed by extremely sharp a large market moves. My belief from the overall context is that this next move will be down, and could be very large. The average bear market leg down is about 26% down. It is possible with such a low ADX that this leg could be larger.

Tuesday, November 15, 2011

Gold Update

This chart is continuous gold prices. For reasons I have covered in detail in recent months, I fully expect the decline off the September high in gold to be the initial leg down of a bear market in gold. I also believe this is likely a long term top in gold based on long term price channels and the overall market context. I have recently posted an inverse ETF trade on gold to make gains as gold falls. The chart above shows (in green) the average 1st bear market rally in gold after a first leg down. The blue line is the projection from the Sept 2011 low of the 2008 first bear market rally. Both project to the first week of December. Recall from my prior post that the average bear market rally in stocks since 2000 projects to the first week of Dec also.

In both cases the current market has already exceeded the average price retracement or percent gain up from the lows, but the time is a bit shorter than typical. So I feel confident that this template is a good one for the current market environment. Both market could peak any time now if they haven't already, and upside is likely limited on an push to new rally highs. It seems likely that both stocks and gold peak around the same time on this rally, and both correct together. I personally believe both will go to new lows below the Sept/Oct lows.

Markets will likely continue to fall in a deflationary theme with most markets down and the US dollar up as ongoing debt problems come into crisis. On a long term investment basis I would be long the US Dollar UUP etf and in virtually nothing else.

Sunday, November 13, 2011

Detailed Historical Projections for the S&P 500

See chart for details. The red rectangle is the expected price/time range for a bear market rally to top based on 2000-2009 comparisons. The green solid line is the average. Our market has already reached the average price gain. However, it would be more typical for the market to burn some more time, and make another minimal high above the Oct 27th high.

The average bear market leg down since 2000 has been 110 days and about -26%. In this chart above I have projected that down from the end of the previously shown average bear market rally which is projected to end the first week of December. That would put the S&P 500 at 954 by the end of March. So we could look at Q1 expiration put options on the S&P 500 on a push to new rally highs over the coming weeks. The blue line I have shown in the prior post, which would be the typical bull market leg up.

This chart shows some chart resistance lines with 1295 being the main overhead resistance that I think is of significance. The vertical lines show the upcoming Fibonacci time relations of the May-Oct decline projected out from the Oct 4th low.

The closest analog to the leg down from May-Oct is the 1st leg down in 2007-2008. The bear market rally to follow topped at a 0.40 time ratio which is an approximate 0.382 time ratio. That is where I think the most likely topping range is in our market. That would put us into the 1st week of December.

Friday, November 11, 2011

Pullback or Consolidation Likely to Continue in Stocks

The market has run up extremely fast over the last month. If you look at the numbers I showed on the bear market rallies in the last 2 bear markets you see that, and on the chart above the blue line shows a typical bull market rally/leg up. The market has greatly exceeded that rate of gain initially, so even if stocks continue to trend up, consolidation is very likely.

Thursday, November 10, 2011

Quick Note

I believe that the markets are setting up for a very sharp move very soon. I expect it to be down. On a purely objective basis check out the DMI/ADX on the QQQ etf. The ADX is at a multi year low as the market is chopping around the top of the last year's range. Also, the ADX has been in a trendless mode for an extended period of time. As I mentioned in some greater detail a couple months back in relation to silver and the US Dollar, an extended trendless period is a basing/consolidation before another large move in the markets.

Also, check out the daily bollinger band configuration on the QQQ. Price has traded in a tight range for the last month, hanging out just above the 200 day SMA. The bands are now squeezed together which is setting up a breakout type move. So far today, the lower band has started to point down while the upper has pointed slightly up from yesterday. This is an indication of volatility expansion, and since price is going down, it is possibly a clue that the next move will be down. The most volatile moves will begin after a band squeeze with the bands suddenly separating sharply and the market closes outside the bands. The duration is always in question but my experience would say that the longer and choppier the trendless environment before the breakout, the sharper and larger the breakout move will be.

So, keep an eye on the bands over the next several days or weeks.

Also, check out the daily bollinger band configuration on the QQQ. Price has traded in a tight range for the last month, hanging out just above the 200 day SMA. The bands are now squeezed together which is setting up a breakout type move. So far today, the lower band has started to point down while the upper has pointed slightly up from yesterday. This is an indication of volatility expansion, and since price is going down, it is possibly a clue that the next move will be down. The most volatile moves will begin after a band squeeze with the bands suddenly separating sharply and the market closes outside the bands. The duration is always in question but my experience would say that the longer and choppier the trendless environment before the breakout, the sharper and larger the breakout move will be.

So, keep an eye on the bands over the next several days or weeks.

Wednesday, November 9, 2011

SPY Pattern Projection

After the brief 2-3 day decline from the Oct 27th high, SPY has rallied to a lower high over 5 days time. This makes the downward move more powerful and suggests that the market may move lower without toward last week's low before breaking the Oct 27th high. So the short term price logic is down. We are seeing about a 2% decline in the premarket futures right now, so a large gap down here will likely kick off a move that I would project should approximate the pink projection line as a normal mild bearish scenario. That would be typical for a "flat" abc correction off the Oct. 27th high.

Now, 2% gaps down are very often filled rather quickly, let's say within the next week or so. So, we may still see new highs for the rally or some chop at these levels if the market does come back and fill the gap down.

My plan is to exit the open SDS trade at the next oversold signal on 60 min stochastics.

Brief Note Regarding GLL

FYI, gold is down about 0.7% in the pre-market, so the GLL ETF would gap up about 1.5% since it is a 2x inverse ETF. So you could keep an eye on if this changes before the market open to calculate position size. But I would use 15.75 as the approximate opening price at this time. The stop will still be 14.25. So the risk per share is $1.50.

The conventional wisdom on position sizing is to risk 2% of trading account or less per trade. There is a precise way to calculate exactly how much to risk, but one has to know win rates and average winner vs loser stats to do that.

The conventional wisdom on position sizing is to risk 2% of trading account or less per trade. There is a precise way to calculate exactly how much to risk, but one has to know win rates and average winner vs loser stats to do that.

Tuesday, November 8, 2011

New Trade - GLL

Buy GLL tomorrow with a GTC sell stop @ 14.25. Current price is 15.56, so that could be used to calculate position size.

GLL is a 2X inverse gold ETF. Gold is right in the target area for a 1st reaction rally high after a bull market high. This is typically the best time to short a market. The time frame for a high may still allow several days or more, but there is bearish divergence on the hourly chart and the daily stochastics is overbought, so I don't feel compelled to wait any longer.

I also am buying Jan 2012 52 puts on GDX at the open tomorrow. GDX is the gold miners ETF.

Thursday, November 3, 2011

Legs Down in the Last Two Bear Markets

2000-2002

-14.3% in 20 days

-18.4% in 111 days

-22% in 50 days

-29% in 122 days

-34.1% in 230 days

-20.7% in 49 days

2007-2009

-20% in 158 days

-48.6% in 186 days

-29% in 60 days

These are the legs down in the last 2 bear markets. A leg down is defined as any move down that does not have a 1 month (or more) low to high correction against the downward trend.

Notice that the typical leg down has been 2-5 months. Now when looking at bull market corrections they are more commonly 4-6 weeks in duration before a corrective low. So if the market is making a high in this area, then we may expect a downtrending move over the next 4 weeks or more.

-14.3% in 20 days

-18.4% in 111 days

-22% in 50 days

-29% in 122 days

-34.1% in 230 days

-20.7% in 49 days

2007-2009

-20% in 158 days

-48.6% in 186 days

-29% in 60 days

These are the legs down in the last 2 bear markets. A leg down is defined as any move down that does not have a 1 month (or more) low to high correction against the downward trend.

Notice that the typical leg down has been 2-5 months. Now when looking at bull market corrections they are more commonly 4-6 weeks in duration before a corrective low. So if the market is making a high in this area, then we may expect a downtrending move over the next 4 weeks or more.

Wednesday, November 2, 2011

Market Update

This chart is a daily SPY chart with a standard 14,3,3 stochastics setting for overbought/oversold. It has just made a bearish cross and trailing 1 bar low sell signal. So there is potential for some selling to follow-through at this time. Also, the decline off the recent high has been larger than any since Oct 4th, so there is an indication that the uptrend so far is likely being corrected on this move. The bollinger bands are now narrowing suggesting a consolidation in effect. Based off of past similar band patterns, I think that a test of the lower band is likely especially if the 20 day SMA is penetrated.

I have posted a GTC sell stop at 19.02 on the open SDS trade at this point. We now have a legitimate stochastics sell signal, so at this point I want to watch the hourly chart for an exit to this trade. I am thinking this may end up as a small loss or small gain by the time the signal comes.

This is a potentially powerful set up for a downside move. The weekly SPX chart with an 8,3,3 stochastics setting is now overbought and starting to roll over. So given the daily chart overbought momentum AND weekly overbought momentum at a LOWER high, the technical analysis is set-up for a possible significant downside move. Also, the market has come back down hard below the 200 day SMA after a brief foray above it. Again, this MA is often a support/resistance area. I believe that trading algorithms get triggered around the 200 day MA which creates "noise" around the MA before the trend reverses or re-establishes.

I am thinking late November may be the next time frame for a significant market inflection point based off of the time of past downward cycles in recent years. If this is indeed a bear market environment, then I would say mid to late December would be a more likely target date, assuming we are seeing an intermediate term high at the current time frame.

Tuesday, November 1, 2011

EUO Stopped Out

The EUO trade entered 9-1-11 was stopped out at breakeven (17.17) last week on 10-27-11. I did not expect such a deep retracement of the breakout move. I will monitor this one for a possible re-entry.

Friday, October 28, 2011

Charts

These are the charts I wanted to show last night. The S&P 500 is at a conjunction of possible chart resistance. The 200 day SMA, the neck line of the head and shoulders, and a long term trendline not visible, are all right in the area of price right now. And there is a low-low = high-high time relationship occurring right now as well. That is a possible time window for reversal.

I have never heard or seen anyone else talk about this concept, and I've noticed it more in individual stock price charts than in indexes, but at times I've seen this in indexes. Basically the idea is that often times the major gap up in a trend will occur at a 61.8% retracement of the high to low of that trend. So when a trend is developing and you get a big gap, you can drag your retracement tool until the 61.8% retracement is at the beginning of that gap, and it will give you an ideal target for the ending price level of that trend. There are two examples on this chart here: the May-Oct decline, and possibly the current explosive uptrend since Oct 4th.

I may give more detail on this later.

Thursday, October 27, 2011

Potential Price and Time Reversal Zone

Blogger is giving me an error in trying to post a couple images tonight. I will put them up when I can. One is a concept I haven't ever really covered in this blog before in any detail, but there are a couple very nice examples of right now on the charts. Basically the high today was pinpointed as the possible rally high by the prior gap up on Oct 10th. So the 1290 is a potential reversal zone.

Also there is a low-low = high-high time relationship possibly in play right now where the time between the Aug 9th and Oct 4th low is equal to the time between the Aug 31st high and the current high. There is one day difference as of today, but at times this relationship will occur before a major trend change/continuation.

While the S&P seems like it will probably be at around 50 billion by late next week, there is the possibility that it is climaxing on a counter trend rally right in this area.

Also there is a low-low = high-high time relationship possibly in play right now where the time between the Aug 9th and Oct 4th low is equal to the time between the Aug 31st high and the current high. There is one day difference as of today, but at times this relationship will occur before a major trend change/continuation.

While the S&P seems like it will probably be at around 50 billion by late next week, there is the possibility that it is climaxing on a counter trend rally right in this area.

Comparison of Bear Market Rallies

The bear market rallies lasting a month or more in the last 2 bear markets are listed below:

2000-2002

14.2% in 140 days

10.2% in 41 days

21.7% in 60 days

24.6% in 108 days

24.4% in 29 days

2007-2009

14.5% in 63 days

27.5% in 46 days

Currently we are up 19% in 24 days which is in the target zone for percent advance in price, but still short on time of what has been typical. So IF this is a bear market rally, which I think it probably is, it is likely to cool down soon, but may put in a higher high in the next few weeks.

Also, today the S&P 500 is bumping up into the 200 day moving average from the underside as well as the neckline of the head and shoulders chart pattern that formed earlier this year between Feb-July. The 200 day SMA is where the initial bear market rally stopped in the 2007-2009 bear market. Additionally the S&P 500 is touching a multi decade support/resistance line from the underside today (connecting the 1987 high and 2002 low).

On a longer term basis there are some significant reasons other than patterns to believe that the market will have difficulty pushing substantially higher. One of the most obvious to me is that the cash levels in major mutual funds is basically hovering at an all time low. The market has historically topped out bull markets when the cash levels fell to 4% or so. And we have been in the lower 3% range for most of the last year. So, while this advance has been amazing off the Oct low, I think the firepower to fuel new bull market highs is limited.

I think that the tops in 2000, 2007, and 2011 all in within about 10-12% of each other in the S&P 500 are an indication that the cash level is too low to be able to push the market higher. Before another major secular bull market it would be sensible in historical comparisons for the cash level to rise to levels suggestive that a multi year advance is sustainable. Another longer term bearish indication from this data is that this cash deficiency is occurring at a LOWER high than the last high in 2007.

2000-2002

14.2% in 140 days

10.2% in 41 days

21.7% in 60 days

24.6% in 108 days

24.4% in 29 days

2007-2009

14.5% in 63 days

27.5% in 46 days

Currently we are up 19% in 24 days which is in the target zone for percent advance in price, but still short on time of what has been typical. So IF this is a bear market rally, which I think it probably is, it is likely to cool down soon, but may put in a higher high in the next few weeks.

Also, today the S&P 500 is bumping up into the 200 day moving average from the underside as well as the neckline of the head and shoulders chart pattern that formed earlier this year between Feb-July. The 200 day SMA is where the initial bear market rally stopped in the 2007-2009 bear market. Additionally the S&P 500 is touching a multi decade support/resistance line from the underside today (connecting the 1987 high and 2002 low).

On a longer term basis there are some significant reasons other than patterns to believe that the market will have difficulty pushing substantially higher. One of the most obvious to me is that the cash levels in major mutual funds is basically hovering at an all time low. The market has historically topped out bull markets when the cash levels fell to 4% or so. And we have been in the lower 3% range for most of the last year. So, while this advance has been amazing off the Oct low, I think the firepower to fuel new bull market highs is limited.

I think that the tops in 2000, 2007, and 2011 all in within about 10-12% of each other in the S&P 500 are an indication that the cash level is too low to be able to push the market higher. Before another major secular bull market it would be sensible in historical comparisons for the cash level to rise to levels suggestive that a multi year advance is sustainable. Another longer term bearish indication from this data is that this cash deficiency is occurring at a LOWER high than the last high in 2007.

Wednesday, October 26, 2011

Stocks and Commodities Update

Based off of a couple chart pattern projections the minimum expected price target has already been met on this rally. Basically the lower range was the low 1250's and the high is around 1275. The daily stochastics is overbought and the weekly 8,3,3 stochastics is almost overbought, so we are close to dual time frame overbought momentum. Another poke up on the hourly chart would push the hourly momentum to overbought as well giving multiple time frames of momentum as overbought.

Based on the structure of the advance off the Oct 4th low, this looks like a complex upward pattern that may complete a second phase advance in the next 1-2 days. The gap down at the 61.8% retracement of the May-Oct decline is still unfilled just overhead. So it would be nice to see that filled in the next day or so, and then possibly we will see a pullback, possibly a significant top, though there is no great reason at this point to expect a top other than price pattern and retracement levels.

If commodities are to continue a downtrend, the correction upward thus far has been right in the range (red box on chart) to see a measured correction based on the other upward corrections in the downtrend. There is some bearish divergence on the daily stochastics at the fill of a major gap down, so this could be a reversal zone.

Thursday, October 20, 2011

Breadth Thrust

I did not include the stock prices on this chart for clarity sake, but this is the NYSE advancers-decliners data with a 63 and 126 day moving average. That represents 1 and 2 quarters of the trading year, respectively. The purple horizontal line is the zero line. Notice that the green 126 day average moved above zero in April of 2009 and remained there for the entire bull market. Now last month it dipped below zero. I take that as a possible breadth signal of a longer term trend change. Right now the green line is back right around zero, so let's keep an eye on how it behaves.

Also I drew some overbought/oversold horizontal lines to see where the peaks of the breadth thrusts were over the past 3 years. Currently the market is right near a 10 day breadth thrust extreme. These have happened in 2 distinct contexts over the last few years. Either the market was coming off a corrective low and was beginning a powerful new multi month trend OR it occurred a little before a peak leading to a sizable correction.

SLV Options

I had mentioned the Oct 34 strike put options I bought for 1.35 on SLV a few weeks back. I sold half of them Sept 29th for 5.10. I sold the rest this morning for 3.65 seeing as expiration is tomorrow with no obvious potential left in them.

No change on the limit order for the SLV short trade to exit at 26.00

No change on the limit order for the SLV short trade to exit at 26.00

Tuesday, October 18, 2011

Update

Today's trade has created some continuing bearish divergence in the stock indexes. Shorter term RSI (3 or 5 period) show nice divergences and the 60 min MACD is at an even lower peak at this high. Price pushed right up to the 1233 level which is at the top of the recent 2 month range and just under the upper daily bollinger band. This all in the context of a late "follow through" day in the markets. So we have some mixed messages here. Despite the follow through day, I think stocks are still likely to pullback before charging through the top of this trading range.

AAPL reported earnings after hours and missed estimates for the first time since the 2009 bull market began. Given the bearish divergences on AAPL developing over the past months, this may be a trend changer in AAPL shares.

GLD gapped down today, but then traded higher all day after that. If my recent outlook on it is generally correct, then given today's action, it may have another brief push to the top of its recent range before the consolidation is complete.

AAPL reported earnings after hours and missed estimates for the first time since the 2009 bull market began. Given the bearish divergences on AAPL developing over the past months, this may be a trend changer in AAPL shares.

GLD gapped down today, but then traded higher all day after that. If my recent outlook on it is generally correct, then given today's action, it may have another brief push to the top of its recent range before the consolidation is complete.

Monday, October 17, 2011

GLD and SPY - Further Pullback I Think

This is a 4 hour chart of GLD, the gold ETF. It is showing a nice bearish divergence suggestive that we may a pullback continuing tomorrow and beyond. My suggestion has been and still is that this is likely to exceed the Sept low at least briefly before a probably reaction rally to a lower high than the all time high.

Silver is positioned similarly on the hourly chart. I expect new lows for the correction.

This is an hourly chart of SPY. Again there is a nice bearish divergence on the MACD here which suggests a continuing pullback ahead. The blue arrow is the level of the unfilled gap down that may attract price on this decline. Also the daily slow stochastics is overbought and made a bearish cross today. To confirm this as a sell signal I like to see the low of the day be broken in the action that follows. So if we make a lower low tomorrow (below today's low) then that will be better confirmation of a high, and I will post a stop on the trade as well.

Saturday, October 15, 2011

Some Details on Stocks and Gold

See the notes on the chart above for gold. Looks to me like it should make another low before a longer rebound rally. The hourly chart has bearish divergence on gold and the retracement level is what I would expect to be the typical amount for this peak if a 5 wave move is occurring off the high in gold. My expected projection is on the chart above.

After a minor bearish divergence on the hourly chart where I posted the recent new SDS trade, stocks have pushed higher, but with an even larger bearish divergence on the hourly chart. I expect the market to pause here for a number of reasons. Again, my target on this pullback, assuming we get one soon here, is 1155 on the SPX. After that I think it is likely that the rally pushes to new highs.

I have spent some time going over some detailed comparisons of our current market and the S&P 500 and gold prices at the end of the prior bull market (2007 top in stocks and 2008 top in gold). The move down off the May 2011 high in stocks to this point has been very similar to the move down off the Oct 2007 high. If the current rally is similar to the March-May 2008 rally then my projection from a recent post is still pretty close, though if it followed that template exactly it should only last 2 months. The general price levels I projected are still the same.

Additionally, behavior in gold has been similar in recent months to it 2008 top and turn down. It rose with stocks for most of the 2003-2007 bull market, but then as the bull market aged and debt/default issues started coming out, it continued to advance to new highs while stocks got hammered initially. Gold peaked 5 months after stocks peaked in Oct 2007, and before peaking gold gained 31% from its level when stocks peaked.

In the last several months (assuming gold has made a high) gold peaked a little over 4 months after stocks peaked. And it gained about 21% from its levels when stocks peaked. After the 2008 peak gold declined for 6 weeks prior to a 2.5 months rally to a lower high. That lower high was a great short sale point on gold and gold stocks. Watch for a similar play here. I believe ABX is setting up for a fantastic short sale in the coming months.

Thursday, October 13, 2011

Pullback Ahead I Think - SDS Filled

See the chart for notes. Basically we are set-up to at least move back toward the unfilled gap up from Monday. If/when we get a stochastics sell signal here, I will post a stop on the new SDS trade and then follow it for an exit strategy.

The opening price on SDS today was 22.42 which will be the blog entry price.

Wednesday, October 12, 2011

Short Term Overbought at Resistance - New Bearish ETF Trade

A marked bearish divergence is present on the 30 min MACD chart of SPY and it also exhibits a "three push" type pattern that is often the end of a move. The MACD has been making lower peaks on the last two bearish crosses, but the SPY has continued substantially higher.

So now we are at a chart resistance area around 1207-1230 on SPX and there is loss of momentum on this move. So we should see a pullback here. At this point my suspicion is that this move down will fill the gap up at 115.65ish on SPY and we may see a retest of 1120 SPX, but I don't have any degree of certainty that we will see new corrective lows before there is further upside.

I am going to post a bearish trade here because I think that it is very unlikely the SPX will be able to push through this resistance area without pulling back to reload the guns first, so to speak. I then expect that most likely a bullish trade will present itself within a week or so.

New Blog Trade:

Buy SDS at the open tomorrow. I am not going to post a stop loss on this one, but exit at the next hourly MACD oversold bullish cross. Also, we could us a limit exit order at the fill of the 115.65 gap on SPY.

Monday, October 10, 2011

Possible Uptrend But Short-Term Overbought

Today was a big gainer in the markets, however the volume came in way lower. In fact volume is at a 14 day low with the biggest price move up or down in the entire period. That seems kind of odd and possibly significant, but I don't have any stats to say one thing or another. So this is not a follow through day. Most follow-through days occur from 4-7 days off the lowest close according to IBD. Today was day 5. So we are in the sweet spot as far as that goes. Granted today was a "holiday" but that shouldn't be an excuse to count this as a sure thing follow through.

Also, for good confirmation of an uptrend, price should have exceeded 1195 today on the cash S&P 500 which it almost did today but didn't quite. This could be forgiven, but still it is not extremely convincing to me especially given the weak volume.

If a corrective low is in place, we may see something corresponding to the green projection above. If not, and the market is headed to lower lows on this move, then we should top quickly with some big downside ahead the next 2 weeks.

As far as trading opportunities, I feel a little foolish for not taking the bullish trade mid last week as the technical set-up was quite nice. From this point here is my plan: If we get a nice reversal on the hourly chart, I will post a bearish trade, but with the idea that I may exit and immediately reverse to a bullish trade if there is reversal back up on the hourly chart.

Sunday, October 9, 2011

SLW Head and Shoulders Top

I have given some detailed analysis of silver and posted some SLV etf trades over the last few months. Also I have mentioned stocks like SLW and SSRI which are silver stocks. I am posting this chart here on SLW because it is an absolute, no doubt about it, meets every criteria in the textbook, head and shoulders top that is at a short sell point NOW, and projects a greater than 50% loss from these levels. I am not going to post a trade on it here because at this point in time that is not the function of this blog.

If you have a technical analysis text book then get it out, check out head and shoulders topping patterns, and compare it to this one as far as price, volume, trendlines, and backtest/return moves. I use John Murphy's Technical Analysis of the Financial Markets.

If last week's low is broken, price should not return to the neckline again. So the chart above offers some basics as far as where the important points are and what the target is. While I can't guarantee anything, I see this one as shooting fish in a barrel. I already hold puts on this one which I got on the day of the high of the right shoulder. But if I didn't hold it, I would get in either ASAP or on a break of last week's low.

Subscribe to:

Comments (Atom)